고객 셀프 서비스 구현을 위한 TAL의 디지털 트랜스포메이션을 지원하고 있는 Okta

time password system requirement

weeks to deploy

- Cloud journey

- Self-service

- Speed is critical

- Simple sign-in

TAL spent several years transforming from a relatively siloed business to a more horizontal enterprise that included two new customer-facing brands. The business looked to the cloud for an improved experience delivering services to its customers.

As part of making the transition towards the cloud, the TAL IT department was looking for a partner that would be able to power a self-service portal for customers to be able to manage their insurance proactively.

TAL selected Okta Identity Cloud for identity and access management based on the speed with which the solution could be deployed and integrated with its existing platform.

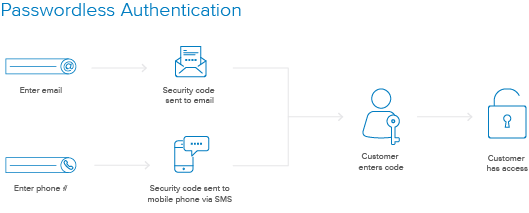

Okta provided a passwordless authentication solution to login with just an email address or mobile phone number to simplify access and reduce calls to IT support.

Passwordless Authentication for TAL customers

As part of TAL’s major business rebrand, the IT team was tasked with delivering an online customer self-service portal to better engage with customers directly. The team quickly realized they needed an identity solution they could deploy quickly to power the high quality customer registration and login experiences with passwordless authentication.

The primary reason for choosing to work with Okta was to bring our customer portal to market faster.

Richard Mountstephens, Lead Enterprise Architect at TAL

Balancing security and flexibility with a revolving workforce

In 2015 TAL, one of Australia’s largest life insurance specialists, embarked on a journey to broaden its business model beyond traditional financial adviser and superannuation fund based distribution channels by extending its offering directly to consumers. Introducing My TAL and Insuranceline to consumers directly opened up a new category for the company. Aware that the insurance industry in Australia is a competitive one, TAL knew it needed a seamless customer experience to win new customers.

To do this, TAL recognised its online channels would be an essential element of TAL’s emerging consumer-facing business, that delivered a secure but easy online experience for its customers. This also needed to be rolled out rapidly to coincide with the brand’s launch and subsequent marketing campaigns. TAL faced different user experience challenges in every part of its existing online portal. As a result, TAL was looking for a way to simplify access to the company’s portal, to make it easier for customers to interact with TAL’s services,to more efficient for the business and resolve insurance issues faster.

The online quote and application experience for TAL’s customers required login credentials. However relying on a password presented a challenge as existing customers were known to interact with TAL infrequently; logging-in one or two times each year to renew their policies or download invoices for tax purposes.

Accelerating the sign-on process

The business found that minimal customers would remember their login details and the majority of users regularly required self-service password resets or calls to customer service, which would put strain on the IT Department and create a poor customer experience. Understanding this insight during the development of its customer portal, TAL engaged Okta to investigate how the business could overcome these challenges, while maintaining security.

TAL was conscious of the fact that customers would likely forget their passwords due to infrequent logging in to their insurance portal. This led TAL to collaborate with Okta to find a login solution based on a one-time password instead of a regular username and password. As a result, TAL decided to implement the Okta Identity Cloud to facilitate a passwordless authentication process that would not require a unique password, a first for an Australian insurance provider.

“Okta’s solutions have helped overcome the challenges we had with password resets due to infrequent customer interaction with our platform,” said Richard Mountstephens, Lead Enterprise Architect at TAL.

Customers now just need to follow a short registration process with a policy number and email address as identification. To login, a customer enters their email address or mobile phone number and TAL sends a security code. After entering in the security code, customers can instantly access the information they need. After selecting Okta, it took six weeks to deploy and become active, just in time for the big launch.

Delivering self-service options for customers

TAL has now successfully opened its consumer channel with the launch of a customer self-service portal supporting two brands, My TAL and Insuranceline, both running on the Okta Identity Cloud. In the following 18 months, TAL rolled out Okta to support half a dozen channels including the financial advisor portal and superannuation funds.

TAL’s IT department continues its modernisation efforts to reduce their legacy IT stack and move to cloud-based infrastructure. The migration to a new cloud-based environment has greatly benefited the business in terms of increased efficiency and productivity in regards to the speed of access to information. The team is currently looking at other areas of the business, including interaction with partners, retailers and potential consumers to further improve online services.

TAL has purchased the Okta Social Authentication for its portal. This means customers will be able to access their insurance information using their social media profiles if they forget some of their existing details. The Okta solution has also been purchased for internal users. This will allow TAL to shift the focus away from identity and access management, to providing an even more comprehensive insurance service in the future, knowing Okta has their security covered.

About TAL

TAL is a life insurance specialist in Australia. For over 140 years, TAL has been protecting people, not things. Today, TAL insures more than 3.7 million Australians. The company employs 1,600 team members across six offices around Australia, and partners with financial advisers and super funds with one shared goal: to protect the lives of Australians and give them choices when they need them most.