Solution Brief: Increasing Agility for Mergers and Acquisitions

Executive Summary

In today’s competitive business climate, mergers and acquisitions have become a key component of many growth strategies. Globalisation, acquisition of new products and services, and enhanced customer footprints are all opportunities that come with mergers and acquisitions.

But M&A is not without downside and risk. Much of this risk stems from technology, and can lead to delays, unproductive employees, underserviced customers and security vulnerability if not carefully managed.

Identity is the element that links so much technical and human change inherent in M&A. As such, seizing control of identity offers a unique opportunity businesses to ensure a positive return on investment from M&A, leading to efficiency, accelerated growth and enhanced security.

M&A is a Strategic Source of Value Creation

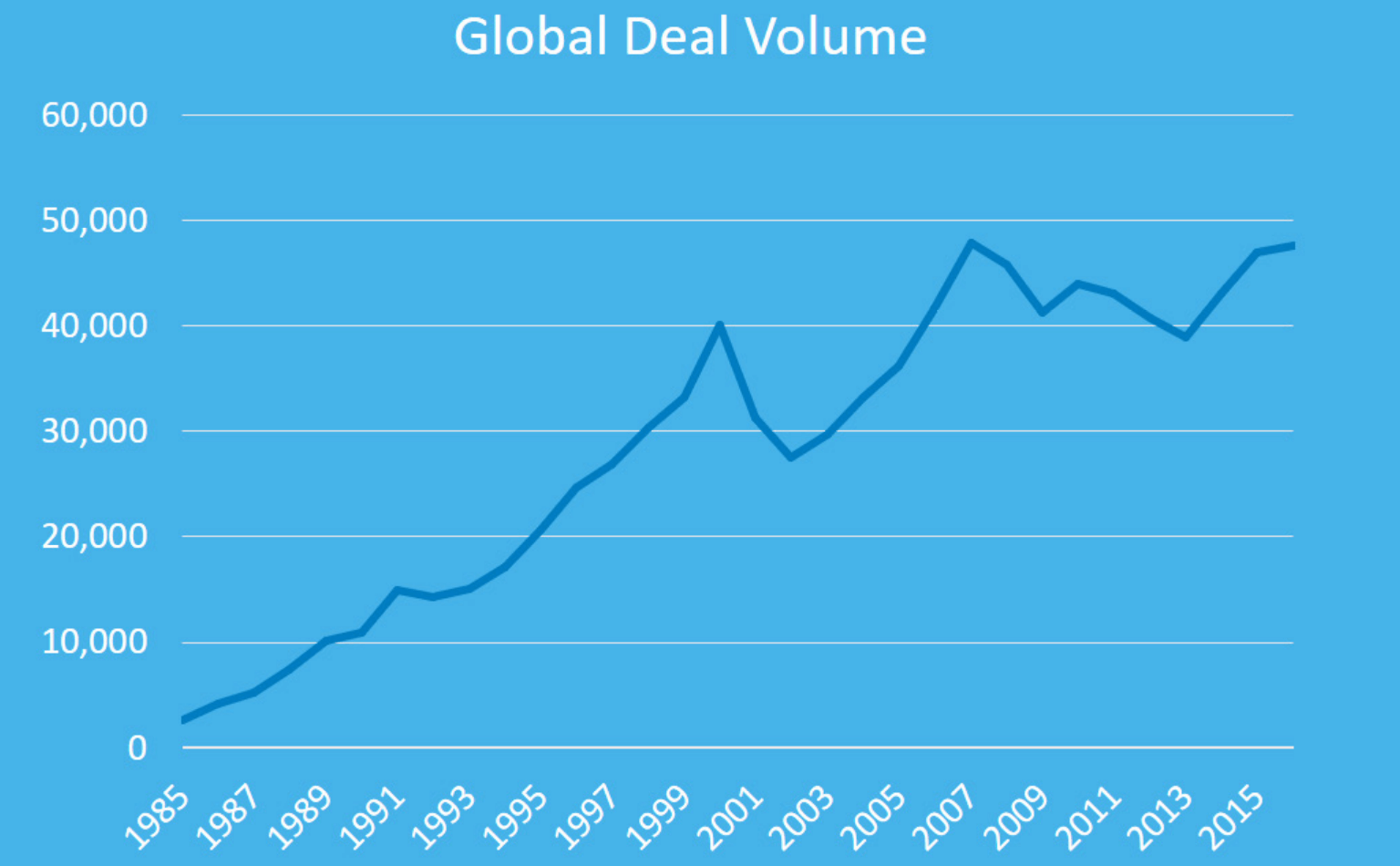

The past 30 years have seen a near exponential increase in global deal volume. Businesses increasingly see mergers and acquisitions as strategic tools to increase shareholder value, and there is no reason to think that trend will abate. A recent Deloitte survey found that:

• 75% of surveyed executives expect deal activity to increase

• 64% expect to see deal size increase and

• 73% expect to divest a business

Accelerating Global M&A Activity

But Complexity, Technology, can be Barriers

As deals get more prevalent and larger, they naturally get more complex. That complexity comes at a cost, manifesting itself in the form of issues along a number of dimensions including:

• Geographical. Businesses will find themselves going to market in new geographies, which introduces traditional challenges like language barriers and cultural norms, but also digital challenges like network latency and data residency requirements.

• Technology and services. Businesses going through M&A transformation may encounter delays to release new products and services as processes are aligned, which could lead to a loss of innovation during the integration period.

• Human capital. Users of merging or acquired organisations frequently have a poor transition experience, dealing with delays in access to surveys as well as changes in information systems, not all of which are deemed positive. If not managed carefully, this can lead to attrition.

• Security. During a period of flux and integration, technology teams are often stretched thin. Integration can also lead to technical points of vulnerability, which makes companies going through M&A an attractive target for hackers.

It is not surprising that IT, as a result, is frequently a costly barrier to effective M&A. Executives agree, indicating that the greatest issues they face with legacy systems are efficiency, cost and speed.

IT can be a costly barrier

Efficiency, cost and speed can all be sources of technological frustration. As a result, 84% of organisations do not realise the expected value of M&A activity.

Speeding Time to M&A Value

Recognising that these technological hurdles can significantly impact the return on a deal, progressive organisations have developed a set of policies and processes they use to streamline the M&A process.

M&A value drivers

These projects run the gamut across people, processes and technology and include:

• Domain consolidation. As new businesses are acquired, the number of domains under management increases. Smart organisations have dedicated teams focused on consolidating and integrating domains.

• Adopting new applications. Integration is often an inflection point to improve the technological footprint for all employees, customers and partners. The path of least resistance is to simply adopt the technology stack of the acquiring company, but a best of breed strategy presents an opportunity to deliver additional value, at increased complexity.

• Automating change management. With the rapid flux in organisational charts, user roles and attrition that comes in M&A, it is critical that businesses become adept in rapid and accurate change.

• Enhanced security response. Due to the rapidly changing technological and access profile of the businesses, security response becomes critical. Companies that anticipate security vulnerability will be able to reduce risk by reacting faster.

Creating dedicated projects to address these areas of M&A change is a great first step in improving execution and driving return on M&A activity.

Identity, the Nexus of M&A Change

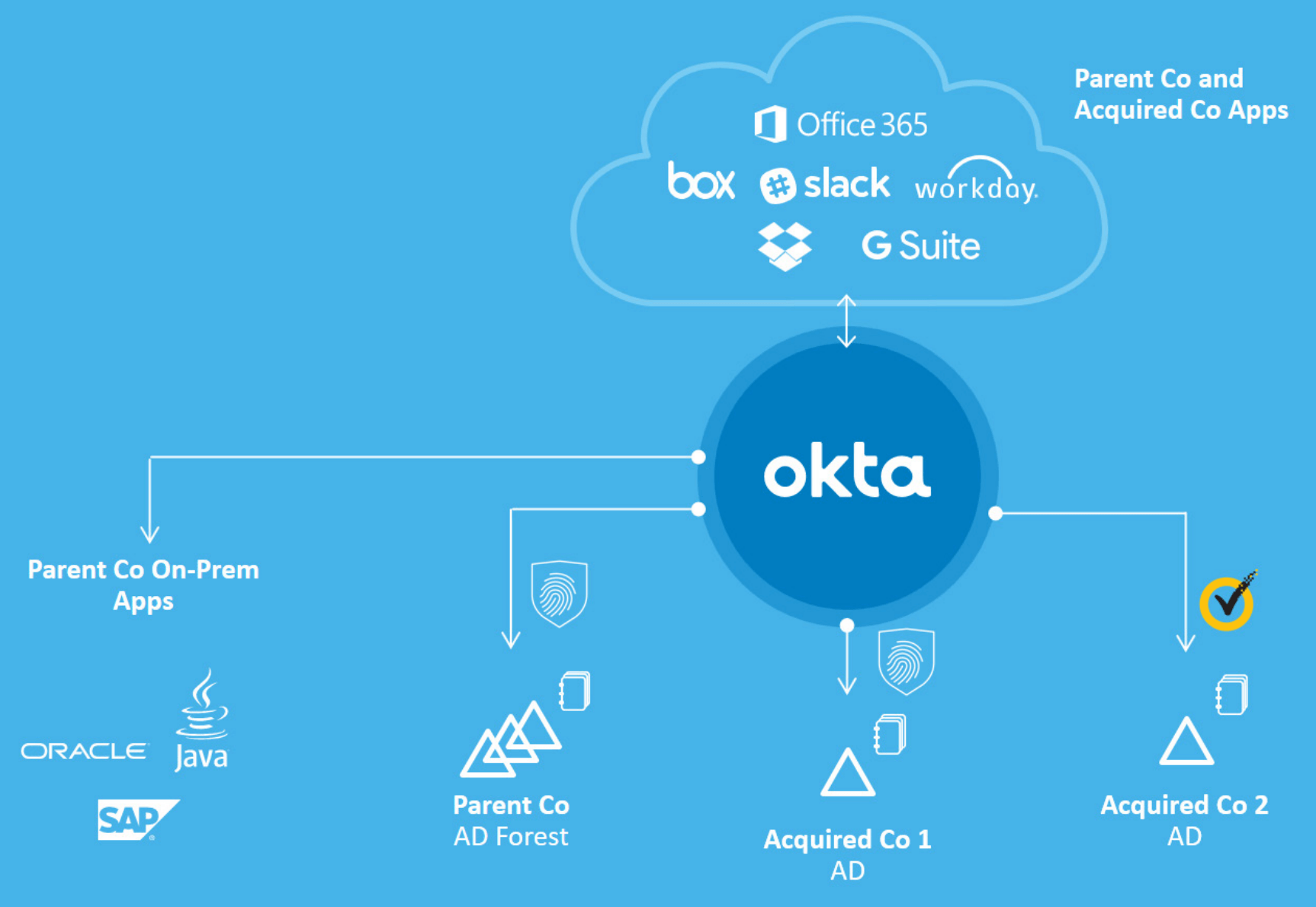

Across all of these dimensions of technical and human change, the common is identity and access. Identity sits at the intersection of people and the technology services they consume. People—parent and acquired employees, partners and customers—require access to technology— applications, devices, services and APIs.

Taking control of identity allows organisations a unique opportunity to automate M&A acceleration projects. Identity provides businesses the ability to deliver a single point of truth, to eliminate or accelerate domain consolidation, connect all technology from day one, and provide a unified, more secure environment.

Why Okta?

Okta’s approach recognises that identity is more than a back office function. Identity, and a modern, cloud-based approach to identity and access management, is a fundamental tool that can transform businesses.

Okta’s transformative approach to business automation applies to the identity lifecycle process, helping businesses decrease M&A costs, accelerate business growth and enhance security.

Decrease M&A costs

• Our approach helps businesses streamline and drastically improve domain consolidation, which decreases IT transformation and maintenances costs

• Directory integration automatically brings in user and group data, eliminating costly and inefficient manual import processes

• Automate M&A related app provisioning requests, decreasing service desk time and increasing user efficiency

• Automated onboarding and account management for Day 1 access to parent company resources, ensuring rapid time to value and happy, efficient employees for less costly attrition

Accelerate business growth

• Day 1 access and easy best of breed IT systems mean productive employees ready to capitalise on new business opportunities

• Scaling up infrastructure is automatic with a 100% cloud solution, which means more productivity as well as better ability to enhance more customers and partners to drive top line revenue

• Faster integration of acquired products and services mean faster time to value and an increased market footprint

• Single view of the customer across products, for enhanced customer analytics and better marketing effectiveness

Enhance security

• Reduced likelihood of a security breach due to tighter identity and access management, which means less reputation loss and brand damage

• Robust policy framework so policies can be managed centrally and flexibly means less security vulnerability

• Out-of-the box, real-time security reporting gives your security analysts more time to spend securing the business and less time wasted on administrative tasks

Roadmap to Success

Ready to get started? We recommend these key success criteria to help you enhance your organisation’s M&A readiness:

1. Eliminate domain consolidation wherever possible. Accelerate the process where necessary

2. Be able to deliver a single source of truth for the post-M&A businesses

3. Support a best of breed technology integration strategy easily and seamlessly, allowing users to get the best of both worlds from the new organisation

4. Provide day 1 access. Strive for maximum productivity from the start for your new organisations.

5. Be ready to unify security early. Eliminate the transitional state as a source of vulnerability and risk for your organisation.

We are Here to Help

Okta delivers a modern suite of identity and access management solutions that help businesses get maximum value from mergers and acquisitions. We have helped businesses of all sizes speed up the process, empowering users with enhanced productivity and driving down security risk.

We do it by connecting everything. We help progressive organisations adopt a modern approach to identity and access that helps employees, customers and partners, of acquirers and acquirees access systems more quickly, efficiently and safely.

Okta streamlines the M&A process