Businesses @ Work

Finance 2018

Businesses @ Work takes an in-depth look into how organizations and people work today — exploring employees, partners, contractors and customers, and the apps and services they use to be productive.

Welcome to our 2018 Businesses @ Work Report - Financial Services Edition! This mini report specifically analyzes trends in financial services organizations relative to what we’re seeing across Okta’s entire network. This report includes only a subset of our broader Businesses @ Work Report takeaways and data. You can view the complete 2018 Businesses @ Work Report here.

How did Okta create this report?

To create all our Businesses @ Work reports, we anonymize Okta customer data from our network of thousands of companies, applications, custom integrations, and millions of daily authentications and verifications from countries around the world. Our customers and their employees, contractors, partners and customers use Okta to log in to devices, apps and services, and leverage security features to protect their sensitive data. Our customers span every industry and vary in size, from small businesses to enterprises with tens of thousands of employees. As you read this report, keep in mind that this data is only representative of Okta's customers, the applications we connect to and the ways in which users access these applications through our service.

Unless otherwise noted, this report presents and analyzes data from November 1, 2016 to October 31, 2017, which we refer to as “this year,” “this past year,” “today” and “in 2017.” Similarly, when we refer to “last year” or “in 2016”, we are referring to data from November 1, 2015 to October 31, 2016. 2015 refers to the same period in its respective year.

Finance 2018

The Data

What are the most popular apps among financial services organizations?

When it comes to apps, Okta’s financial services customers certainly have their favorites. For this report, we’ve analyzed the most popular apps based on those with the largest number of customers with the application provisioned.

Most Popular Apps (Number of Customers)

- Financial Services Customers

- Global Customers

Financial Services Customers

Here are a few notable differences from the global data:

- Similar to our global customer base, Office 365 is far and away the most popular app across Okta’s financial services customers. Nearly 50% more of these organizations use Office 365 than use second most popular app, Salesforce.

- Office 365 has more than 2.75x the number of financial services customers in our network vs. G Suite. G Suite is less popular among Okta’s financial services customers compared to our global customer base (7th most popular app vs. 4th most popular app, respectively).

- Box is more popular among financial services customers (3rd) compared to our global customer base (5th). Box’s popularity in this highly regulated vertical can be attributed, in part, to its focus on security and compliance.

What are the fastest growing apps among financial services customers?

We can’t help but notice that our fastest growing apps for financial services customers look very similar to the fastest growing apps from our 2017 Businesses @ Work Report.

Fastest Growing Apps

- Financial Services Customers

- Global Customers

Financial Services Customers

Note: This graph shows the change in rank of each app over time based on Okta’s number of customers that make that app available to their employees, contractors, partners, and customers. Growth is from 11/1/16 - 10/31/17.

Global Customers

Note: This graph shows the change in rank of each app over time based on Okta’s number of customers that make that app available to their employees, contractors, partners, and customers. All apps had at least 100 customers at the end of the period.

Financial services has been slightly slower to adopt cloud apps to-date (see median apps data below). Will financial services customers focus on adopting security and collaboration next year? Only time will tell!

A few notable findings:

- Zoom grew 206% among financial services customers compared to 164% (4th) in our 2018 global report.

- Slack is still seeing tremendous growth in the financial services vertical. It was the 3rd fastest growing app among financial services customers in 2017. Slack was notably absent from the fastest growing apps in our global report. (It graduated to our top apps chart.)

Do financial services customers favor Office 365, G Suite or both?

In every Businesses @ Work Report we like to compare adoption trends for G Suite and Office 365. When we dug into the details of our financial services customers, it was clear: they are all in on Office 365. Nearly three times as many financial services customers use O365 than use G Suite. Among our global customer base, roughly two times as many customers use Office 365 as they do G Suite.

Percentage of Customers Using Office 365, G Suite, or Both

- Financial Services Customers

- Global Customers

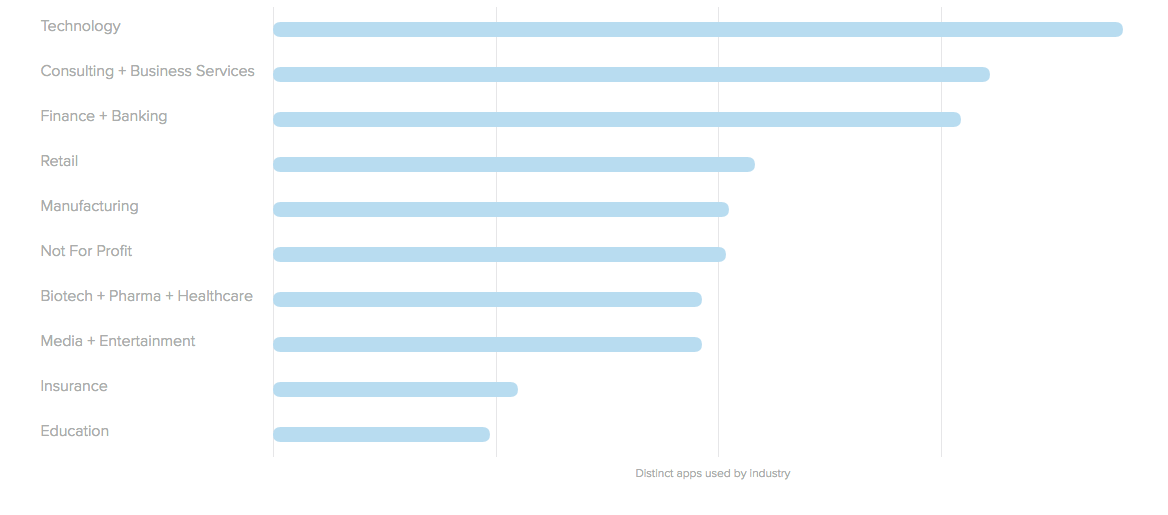

How many different apps are financial services organizations using compared to other industries?

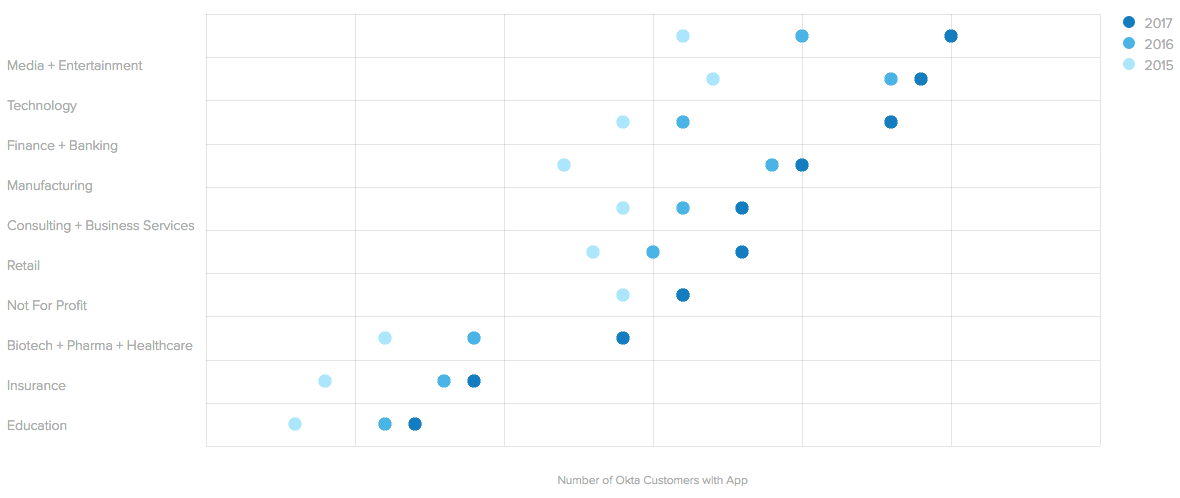

The financial services industry is going all in on the cloud. Over the past two years, the median number of apps per financial services customer has increased 47% compared to 24% by our global customers base. (The median number of apps among financial services customers grew 33% from 2016 to 2017.)

Distinct Number of Apps Used, By Industry

- Technology

- Consulting + Business Services

- Financial Services

- Retail

- Manufacturing

- Not For Profit

- Biotech + Pharma + Healthcare

- Media + Entertainment

- Insurance

- Education

Median Number of Apps by Industry, Over Time

- Media + Entertainment

- Technology

- Financial Services

- Manufacturing

- Consulting + Business Services

- Retail

- Not For Profit

- Biotech + Pharma + Healthcare

- Insurance

- Education

- 2017

- 2016

- 2015

Why are financial institutions suddenly adopting so many cloud apps? The cloud is certainly not a novel concept anymore. In fact, according to IDC, worldwide public cloud services spending is forecasted to reach $160 Billion in 2018 alone, and banking is forecasted to spend more than $16.7 Billion.1 We’re seeing continuing evidence that even among the most highly regulated industries, the cloud is a proven and trusted environment today. And, as IT environments are becoming increasingly complex, the speed and agility that the cloud offers is critical. As Bharat Patel, VP of Corporate IT at NASDAQ explains, “we used to be very centered on Europe and the U.S. Our focus has now become global, so we have to deliver many of our corporate services no matter where people are, and it’s got to just work. It’s got to be simple, and it has to be something that people will immediately use.”

1) Worldwide Public Cloud Services Spending Forecast to Reach $160 Billion This Year, According to IDC.

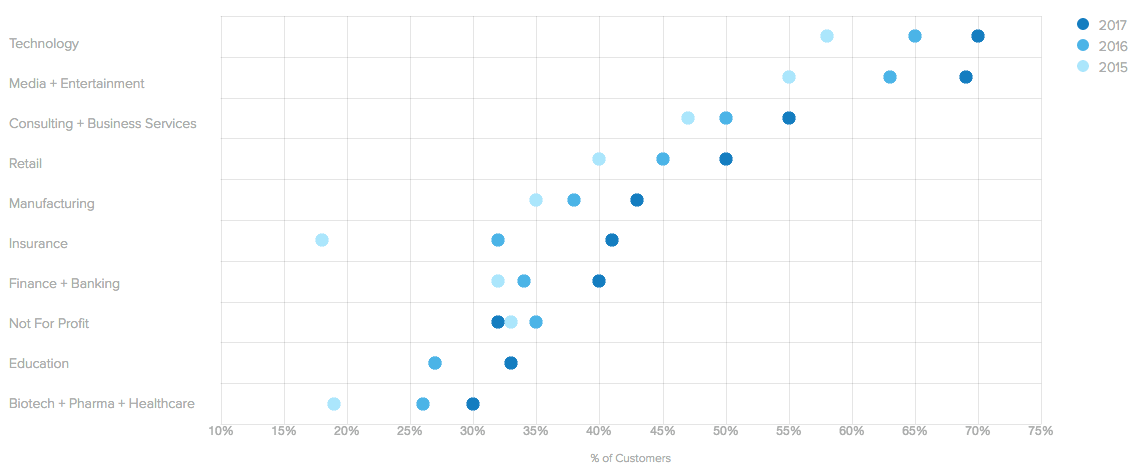

How has developer tool adoption changed across the financial services industry?

Financial services customers have been slower to adopt developer tools compared to Okta’s global customer base, to date.

Change in Popularity of Developer Tools Over Time

- Technology

- Media + Entertainment

- Consulting + Business Services

- Retail

- Manufacturing

- Insurance

- Financial Services

- Not For Profit

- Education

- Biotech + Pharma + Healthcare

- 2017

- 2016

- 2015

Note: Includes customers that have at least one developer tool as of October 31, 2015, 2016 and 2017.

47% of Okta’s global customer base used at least one developer tool as of October 31, 2017, compared to 40% of Okta’s financial services customers. That said, the percentage of these customers who are using at least one dev tool is on the rise. In 2015, just 32% of financial services customers were using at least one dev tool. Similar to our global customer base, JIRA is far and away the number one dev app used in the industry.

How are leaders in the financial services industry using Okta?

- As part of their cloud journey, Nasdaq, a leading provider of trading, clearing, exchange technology, and public company services, migrated from legacy, on-prem identity infrastructure and to the Okta Identity Cloud. Okta provides Nasdaq’s +5,000 employees and contractors a centralized access point for 25 applications and addresses the organization’s security, reliability and usability requirements. Learn more about Nasdaq and Okta.

- Technology plays a critical role for Experian as the organization transforms from a credit reporting agency to a customer-driven data services company. Just ask CIO, Barry Libenson. First, Experian standardized on Okta internally, and in less than a year, 16,000 employees and their applications were consolidated within Okta, allowing Experian to replace six existing systems and save over an estimated $1M annually. Next, the organization turned to Okta to serve as the identity layer for external business services applications and Experian’s API services environment.

- Funding Circle, a small business lending marketplace, selected Okta to provide secure identity management and multifactor authentication for 750 users across their global platform. With Okta, Funding Circle saw an 80% reduction in password resets and is able to provide a better user experience for employees to access their most important applications. Learn more about Funding Circle and Okta.