Businesses @ Work

Retail 2018

Businesses @ Work takes an in-depth look into how organizations and people work today — exploring employees, partners, contractors and customers, and the apps and services they use to be productive.

Welcome to our 2018 Businesses @ Work Report - Retail Edition! This mini report specifically analyzes trends in retail organizations relative to what we’re seeing across Okta’s entire network. This report includes only a subset of our broader Businesses @ Work Report takeaways and data. You can view the complete 2018 Businesses @ Work Report here.

How did Okta create this report?

To create all our Businesses @ Work Reports, we anonymize Okta customer data from our network of thousands of companies, applications, custom integrations, and millions of daily authentications and verifications from countries around the world. Our customers and their employees, contractors, partners and customers use Okta to log in to devices, apps and services, and leverage security features to protect their sensitive data. Our customers span every industry and vary in size, from small businesses to enterprises with tens of thousands of employees. As you read this report, keep in mind that this data is only representative of Okta's customers, the applications we connect to and the ways in which users access these applications through our service.

Unless otherwise noted, this report presents and analyzes data from November 1, 2016 to October 31, 2017, which we refer to as “this year,” “this past year,” “today” and “in 2017.” Similarly, when we refer to “last year” or “in 2016”, we are referring to data from November 1, 2015 to October 31, 2016. 2015 refers to the same period in its respective year.

Retail 2018

The Data

What are the most popular apps among retail customers?

We first dug in to see which apps are most popular among our retail customers. For this report, we’ve analyzed the most popular apps based on those with the largest number of customers with the application provisioned.

Most Popular Apps (Number of Customers)

- Retail Customers

- Global Customers

- Similar to our global customer base, Office 365 is the most popular app used across Okta’s retail customers. In fact, 47% more retail customers use Office 365 than the second most popular app, Salesforce. Salesforce is the second most popular app in this industry, the same as our global customer base.

- Customer service is the name of the game in the retail industry. Zendesk makes its way into the top 10 apps for retail customers who are prioritizing fast response rates to questions and issues that customers raise.

What are the fastest growing applications among retail customers?

When we look at app adoption across our customer base, we specifically dug in to see not just which apps are the most popular, but which are gaining in popularity.

Fastest Growing Apps

- Retail Customers

- Global Customers

Retail Customers

Note: This graph shows the change in rank of each app over time based on Okta’s number of customers that make that app available to their employees, contractors, partners, and customers. Growth is from 11/1/16 - 10/31/17.

Global Customers

Note: This graph shows the change in rank of each app over time based on Okta’s number of customers that make that app available to their employees, contractors, partners, and customers. All apps had at least 100 customers at the end of the period.

Notably, the fastest growing apps among Okta’s retail customers last year have no overlap with the fastest growing apps among our global customer base. Similar to our 2017 Businesses @ Work Report, Slack tops the charts, showing that messaging and communication is a key priority for retailers.

In an on-demand world, customer service for retailers is difficult, and increasingly-important. Retailers need to listen and act quickly to gain and retain customers. Carter Lee, CTO of Overstock.com, says, “We are primarily an internet retailer, but we are also what I consider a technology company-- that’s what sets us apart from our competition.”

We’re seeing retail customers turn to ServiceNow and Zendesk to provide exceptional customer service and become technology-first companies -- one of the reasons these two apps made it into the fastest growing apps.

Also, when it comes to collaboration and content management, the competition is heating up! Dropbox and Box are both top apps among retail customers (#10 and #4, respectively) and Dropbox is on the rise as one of the fastest growing apps this past year.

Do retail customers favor Office 365, G Suite or both?

Retail customers appear to be all in on Office 365. 27% of these organizations are using G Suite today, while 53% are using Office 365. In comparison, 31% of our global customer base uses G Suite today, with 58% using Office 365 for their core email. Notably, 16% of retail customers are deploying a best of breed strategy and actually using both Office 365 and G Suite, compared to the 11% of global customers. In instances where a customer is using both applications, we typically see them using Office 365 for email and G-Suite for documents and collaboration.

Percentage of Customers Using Office 365, G Suite, or Both

- Retail Customers

- Global Customers

How many different apps are retail customers using compared to other industries?

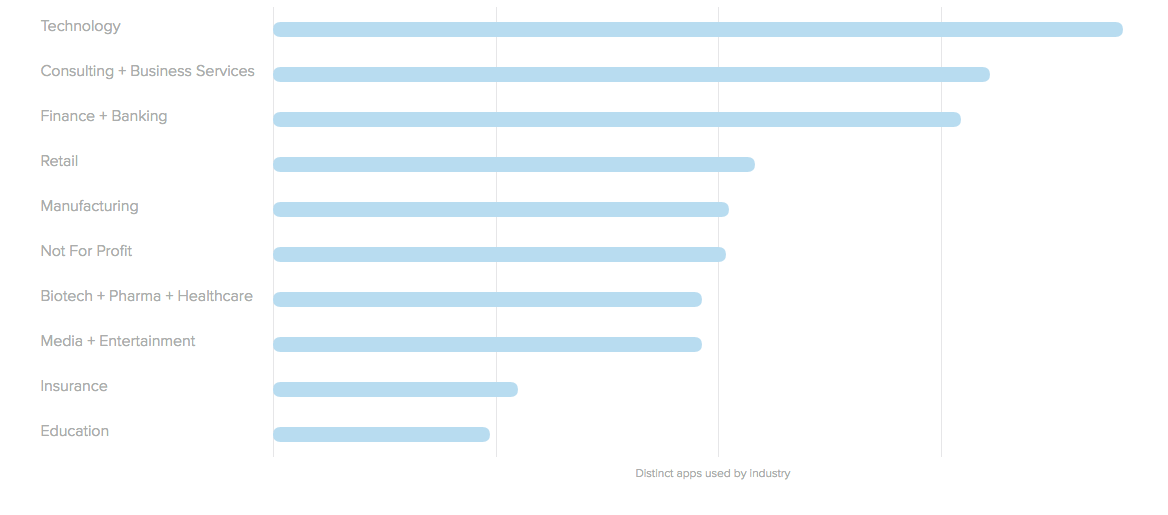

When we looked at the number of distinct apps used by the top 10 industries in our network, retail came in fourth overall.

Distinct Number of Apps Used, By Industry

- Technology

- Consulting + Business Services

- Financial Services

- Retail

- Manufacturing

- Not For Profit

- Biotech + Pharma + Healthcare

- Media + Entertainment

- Insurance

- Education

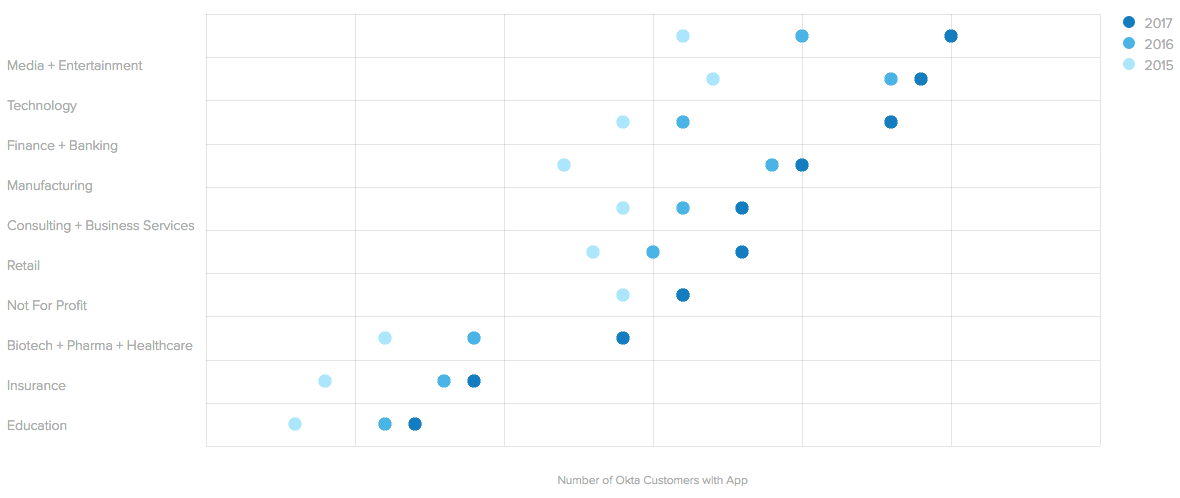

Median Number of Apps by Industry, Over Time

- Media + Entertainment

- Technology

- Financial Services

- Manufacturing

- Consulting + Business Services

- Retail

- Not For Profit

- Biotech + Pharma + Healthcare

- Insurance

- Education

- 2017

- 2016

- 2015

Customers in the retail industry have deployed 1090 distinct apps, demonstrating that they’re not just deploying the popular apps, but using a wide variety of apps to suit their specific business needs.

Over the past two years, the median number of apps per retail customer has grown 28% versus our global customer base which has grown by 24%.

With more and more apps to manage, retail customers such as Massdrop, a community-driven commerce platform, need to provide employees with instant, secure access to their cloud apps. With Okta, Massdrop has realized an increased productivity of more than $60,000 per year.

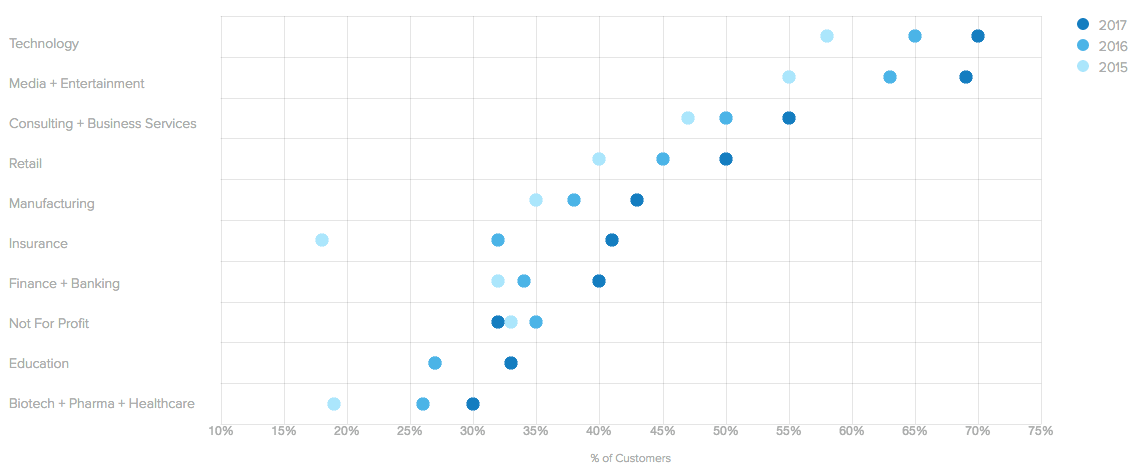

How has developer tool usage changed across retail companies?

With online shopping experiences becoming more important than ever, retailers are seriously embracing digital transformation. In fact, our retail customers use more developer tools than any other industry.

Change in Popularity of Developer Tools Over Time

- Technology

- Media + Entertainment

- Consulting + Business Services

- Retail

- Manufacturing

- Insurance

- Financial Services

- Not For Profit

- Education

- Biotech + Pharma + Healthcare

- 2017

- 2016

- 2015

Note: Includes customers that have at least one developer tool as of October 31, 2015, 2016 and 2017.

50% of retail customers used at least one developer tool in 2017, up 11% since 2015 AND more than our global customer base at 47%.

So, what are the leading tools? JIRA takes the lead, making dev teams more agile. Also on the list is New Relic, delivering the data retailers need to improve e-commerce operations driving more customers to “add to cart” and get through check out, faster. Cha-ching! With more flash sales and an increase in online shopping, solving incidents quickly has become make-or-break for retail customers, which is why we also see PagerDuty making its way to the top of our developer tools list. With the heavy adoption of developer tools, and more brick & mortar businesses developing their ecommerce arms (ecommerce sales grew 15% compared to just 5% for brick and mortar last year!), we predict this trend will only continue to accelerate.

How are leaders in the retail industry using Okta?

- With Okta, Massdrop was able to efficiently manage application access, streamline onboarding and offboarding and improve user experience for its growing employee base. With the Okta Identity Cloud in place, password reset requests have been reduced by 90%. Overall, Okta’s productivity features have already saved Massdrop over $60,000. Learn more about Massdrop and Okta.

- As Overstock.com embraced the cloud, the online retail company knew they needed to transition away from old infrastructure and move to a centralized system to manage employee access. With Okta, Senior Vice President of Technology, Carter Lee shares that the company can easily provision new applications in minutes, and he know “ these applications are secure no matter when or where users are accessing them.” Learn more about Overstock.com and Okta.