Businesses @ Work

Healthcare 2018

Businesses @ Work takes an in-depth look into how organizations and people work today — exploring employees, partners, contractors and customers, and the apps and services they use to be productive.

Welcome to our 2018 Businesses @ Work Report - Healthcare Edition**! This mini report specifically analyzes trends in healthcare, pharma and biotech organizations relative to what we’re seeing across Okta’s entire network. This report includes only a subset of our broader Businesses @ Work Report takeaways and data. You can view the complete 2018 Businesses @ Work Report here.

** Includes Okta’s healthcare, pharma and biotech customer base. Throughout the report, we will refer to this group as “healthcare.”

How did Okta create this report?

To create all our Businesses @ Work reports, we anonymize Okta customer data from our network of thousands of companies, applications, custom integrations, and millions of daily authentications and verifications from countries around the world. Our customers and their employees, contractors, partners and customers use Okta to log in to devices, apps and services, and leverage security features to protect their sensitive data. Our customers span every industry and vary in size, from small businesses to enterprises with tens of thousands of employees. As you read this report, keep in mind that this data is only representative of Okta's customers, the applications we connect to and the ways in which users access these applications through our service.

Unless otherwise noted, this report presents and analyzes data from November 1, 2016 to October 31, 2017, which we refer to as “this year,” “this past year,” “today” and “in 2017.” Similarly, when we refer to “last year” or “in 2016”, we are referring to data from November 1, 2015 to October 31, 2016. 2015 refers to the same period in its respective year.

Healthcare 2018

The Data

What are the most popular apps among healthcare customers?

When it comes to apps, Okta’s healthcare, biotech and pharma customers certainly have their favorites. For this report, we’ve analyzed the most popular apps based on those with the largest number of customers with the application provisioned.

Most Popular Apps (Number of Customers)

- Healthcare Customers

- Global Customers

Healthcare Customers

Note: This particular set of data looks at apps that are most commonly used by office workers, employees, contractors, partners and customers, versus external-facing patient care.

- Similar to our global customer base, Office 365 is far and away the most popular app used internally across Okta’s healthcare customers. In fact, 75% more healthcare customers use Office 365 than the second most popular app, Concur. (Concur is the second most popular app in this industry, compared to 6th among our global customer base.)

- Veeva, which provides cloud-based software specifically for life sciences companies, is the 6th most popular app among healthcare customers. It’s particularly interesting to see more healthcare customers are using Veeva compared to apps as pervasive and industry-agnostic as G Suite or ADP, demonstrating its dominance in the industry.

- G Suite is the 7th most popular app among healthcare companies, but 4th across our global network. However we anticipate G Suite will continue to move up the ranks, as it is the fastest growing app among healthcare companies in our network today.

- Notably collaboration apps including Slack and JIRA didn’t make the top apps list for healthcare customers, while they are both in the top apps list for global customers.

What are the fastest growing applications among healthcare customers?

The fastest growing apps among Okta’s healthcare customers have no overlap with the fastest growing apps among our global customer base.

Fastest Growing Apps

- Healthcare Customers

- Global Customers

Healthcare Customers

Note: This graph shows the change in rank of each app over time based on Okta’s number of customers that make that app available to their employees, contractors, partners, and customers. Growth is from 11/1/16 - 10/31/17.

Global Customers

Note: This graph shows the change in rank of each app over time based on Okta’s number of customers that make that app available to their employees, contractors, partners, and customers. All apps had at least 100 customers at the end of the period.

Today, Okta’s healthcare customers remain focused on building out their app stack with core apps like G Suite, AWS, and DocuSign. This is due, in part, to the fact that healthcare customers have been slower to adopt cloud apps than other industries. Why? Healthcare is one of the most highly regulated industries. As, Mark Hagan, Chief Information Officer at Envision Healthcare says, “When we think about cloud, we think about security first and what data is being put there.”

Technology Requires Scalability

According to Forrester Research, “Many of the technologies ready to improve health outcomes, expand consumer access to quality care, and slow rising costs require the scalability of the cloud. Traditionally, risk-averse organizations deploy large on-premises systems that don't scale or integrate well with other systems; given the growth of medical data, this approach is unsustainable ... Cloud providers' willingness to share responsibility for HIPAA compliance in business associate agreements is also increasing cloud adoption of as-a-service platforms in healthcare.”* As security concerns become less of a barrier to adoption, we anticipate healthcare’s fastest growing apps chart will more closely mimic “up and comer” apps like the fastest growing apps chart for our global customer base.

*The US Healthcare Security Benchmark 2017 To 2018, Forrester Research, Inc., 17 January 2018.

Do healthcare customers favor Office 365, G Suite or both?

In every Businesses @ Work Report we like to compare adoption trends for G Suite and Office 365. When we dug into the details of our healthcare customers, it was clear: they’re all in on Office 365. Only 20% of healthcare customers are using G Suite today, and of those, only 9% are using it alone (i.e. don’t also use Office 365). In comparison, 31% of our global customer base uses G Suite today, and of that, 16% of are using it without Office 365. But in the cloud, the race is never over. G-Suite is the fastest growing app in healthcare, so we wouldn’t be surprised to see the gap narrow over time.

Percentage of Customers Using Office 365, G Suite, or Both

- Healthcare Customers

- Global Customers

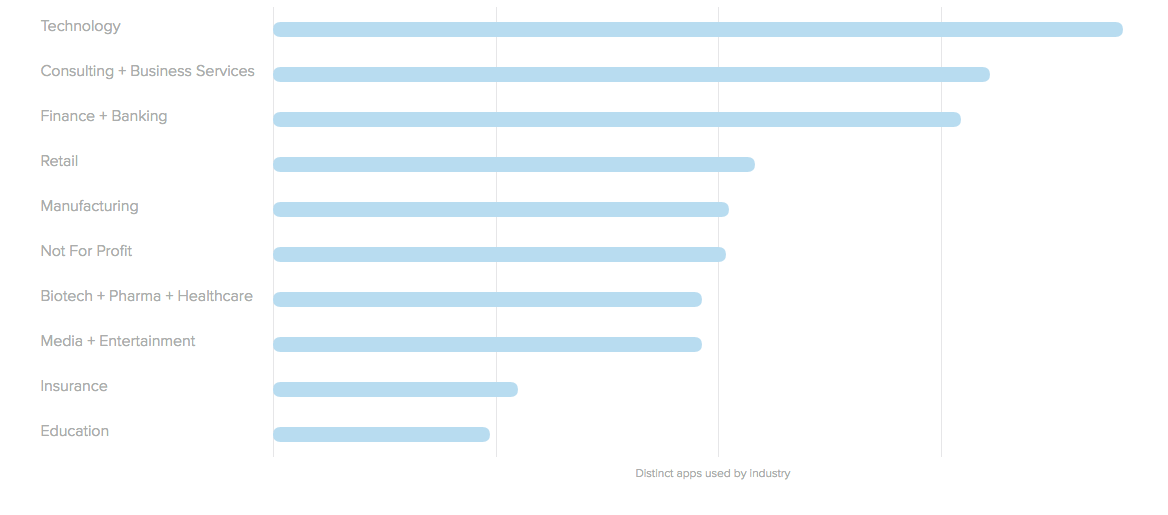

How many different apps are healthcare customers using compared to other industries?

Since healthcare companies face another level of complexity when it comes to security and personal information, they haven’t been early adopters of cloud applications.

Distinct Number of Apps Used, By Industry

- Technology

- Consulting + Business Services

- Financial Services

- Retail

- Manufacturing

- Not For Profit

- Biotech + Pharma + Healthcare

- Media + Entertainment

- Insurance

- Education

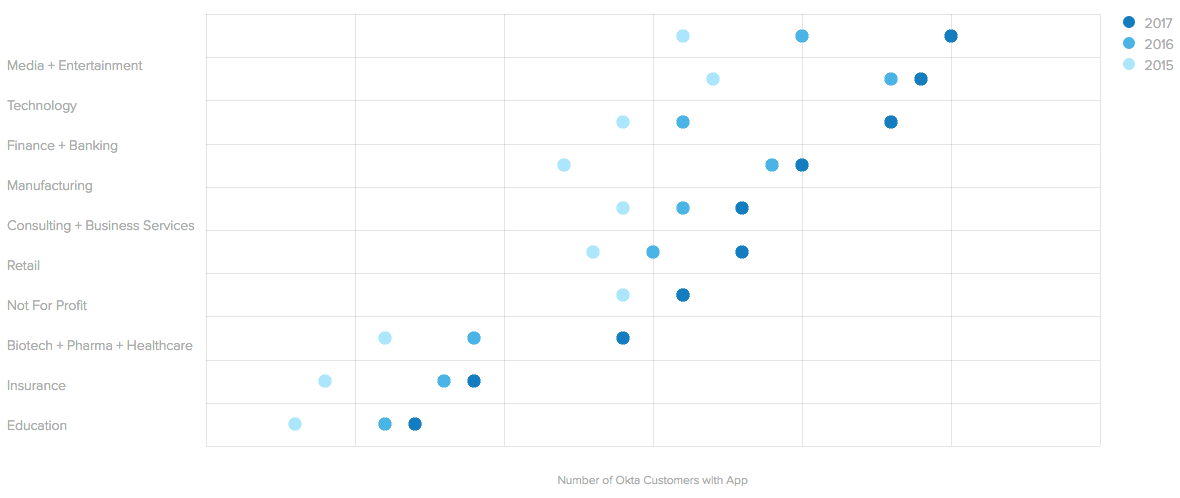

Median Number of Apps by Industry, Over Time

- Media + Entertainment

- Technology

- Financial Services

- Manufacturing

- Consulting + Business Services

- Retail

- Not For Profit

- Biotech + Pharma + Healthcare

- Insurance

- Education

- 2017

- 2016

- 2015

Note: This graph shows the change in rank of each app over time based on Okta’s number of customers that make that app available to their employees, contractors, partners, and customers. All apps had at least 40 healthcare customers at the end of the period.

Rish Tandon, CTO of Heal explains, “as a healthcare company, it goes way beyond just traditional PII. We have to ensure that when it comes to our patients, their records are completely safe.” However as more cloud applications ensure proper security and privacy measures, healthcare customers have accelerated their adoption of best of breed apps. In fact, the median number of apps per healthcare customer has increased an impressive 58% from 2015 to 2017, well above the 24% growth of Okta’s global customer base. From last year to this year specifically, customers in the healthcare vertical saw the largest growth in number of apps across Okta’s top 10 industries.

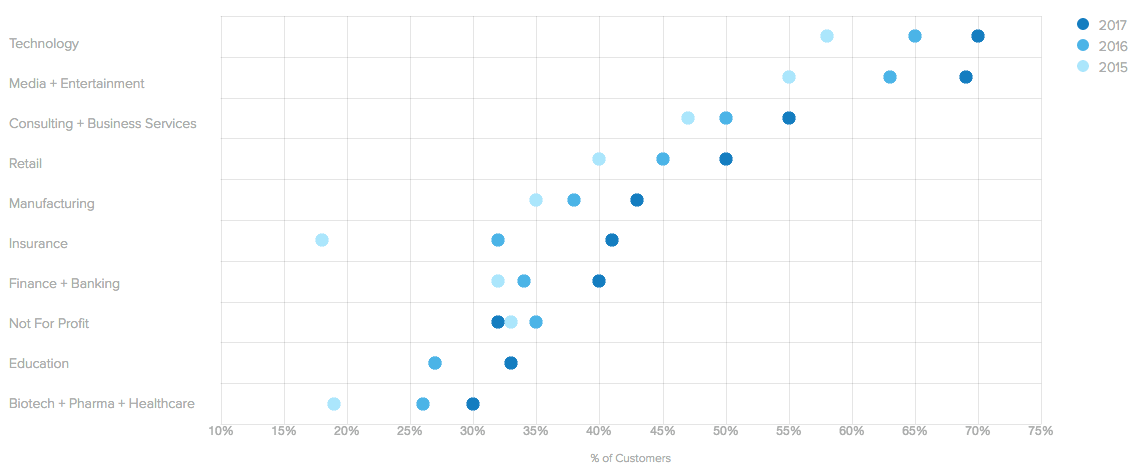

How has developer tool usage changed across healthcare companies?

Healthcare customers are also just getting started with developer tools, compared to Okta’s global customer base.

Change in Popularity of Developer Tools Over Time

- Technology

- Media + Entertainment

- Consulting + Business Services

- Retail

- Manufacturing

- Insurance

- Financial Services

- Not For Profit

- Education

- Biotech + Pharma + Healthcare

- 2017

- 2016

- 2015

Note: Includes customers that have at least one developer tool as of October 31, 2015, 2016 and 2017.

47% of Okta’s global customer base used at least one developer tool as of October 31, 2017, compared to 30% of Okta’s healthcare customers. That said, the percentage of healthcare customers using at least one dev tool has grown significantly over the past 2 years. In 2015, just 19% of healthcare customers were using at least one dev tool. Today, more healthcare organizations are starting off cloud-first, or committing to building their digital footprint.

How are leaders in the healthcare industry using Okta?

- Envision Healthcare, a provider of physician-led, outsourced medical services and coordinated clinically-based care solutions, turned to the cloud to support a mobile workforce, enhance security and adhere to HIPAA rules. As the company grew through acquiring companies, CIO Mark Hagan saw a need for solution to help manage identities and secure accessibility. With Okta, Envision healthcare gained control over who has access to services and insight into how users are abiding by company security policies. Learn more about Envision Healthcare and Okta.

- Heal is an on-demand healthcare provider that provides care to patients directly at home. Through Heal’s “On Call” app, patients can schedule appointments from any mobile device and receive a visit from primary care physician within hours. The Heal team launched the HIPAA-compliant app using Okta APIs for authorization. Today, customers and employees alike can securely log in to the app to access critical information.

- Gavi, the Vaccine Alliance is dedicated to creating equal access to vaccines for all children. To support Gavi’s 300 full-time staff members, and thousands of global affiliates and volunteers, Chief Knowledge Officer David Nix moved the organization the cloud and selected Okta for identity management. Within six weeks, 14 applications were integrated to Okta to simplify access to crucial information, and less than two weeks after the Okta launch, 90% of the team were using the solution.