Identity and Access Management for Financial Services

Banks, insurers, advisors, and exchanges trust Okta for identity

How Okta helps the financial services industry

6.6%

Growth of monthly mobile banking customers

Midwest-based retail bank

$1M

Annual cost savings by deprecating six legacy solutions

Experian

2,000+

Hours of work saved per year for the technology team

Leading national bank and mortgage servicer

- Deliver streamlined, secure experiences

- Secure ALL your apps—on prem and in the cloud

- Implement Zero Trust security to digitize without adding risk

Deliver streamlined, secure experiences

Your customers expect seamless, personalized experiences; convenience; and easy-to-use apps and resources. Your employees and partners expect to be able to do their work efficiently and securely.

With identity and access management, you can protect and enable your employees, agents, brokers, customer service reps, and business partners, while also building secure, digital experiences for your customers.

Secure ALL your apps—on prem and in the cloud

Many financial services organizations are working on moving some or all of their systems to the cloud. You need an access management solution that can manage both on-premises and cloud access cohesively to keep your systems secure no matter where you are on your cloud journey.

Plus, when you have a unified system for identity and access management, you can eliminate manual processes like lifecycle management and provisioning and deprovisioning of identities, and you can remove data silos by integrating with apps to collect and synchronize user identities and data across a number of directories.

Implement Zero Trust security to digitize without adding risk

Adhering to policies and rules is critical to mitigate the additional risks brought on by remote work and adapt to the regulations of the financial services space.

Identity-driven Zero Trust security can help.

With Zero Trust security, you can minimize overly permissioned users; integrate with risk and fraud vendors; and address open banking concepts with secure API management, fine-grained authorization, and strong customer authentication for payment transactions, all without causing more friction or risk to the customer.

Take every type of financial services interaction to the next level

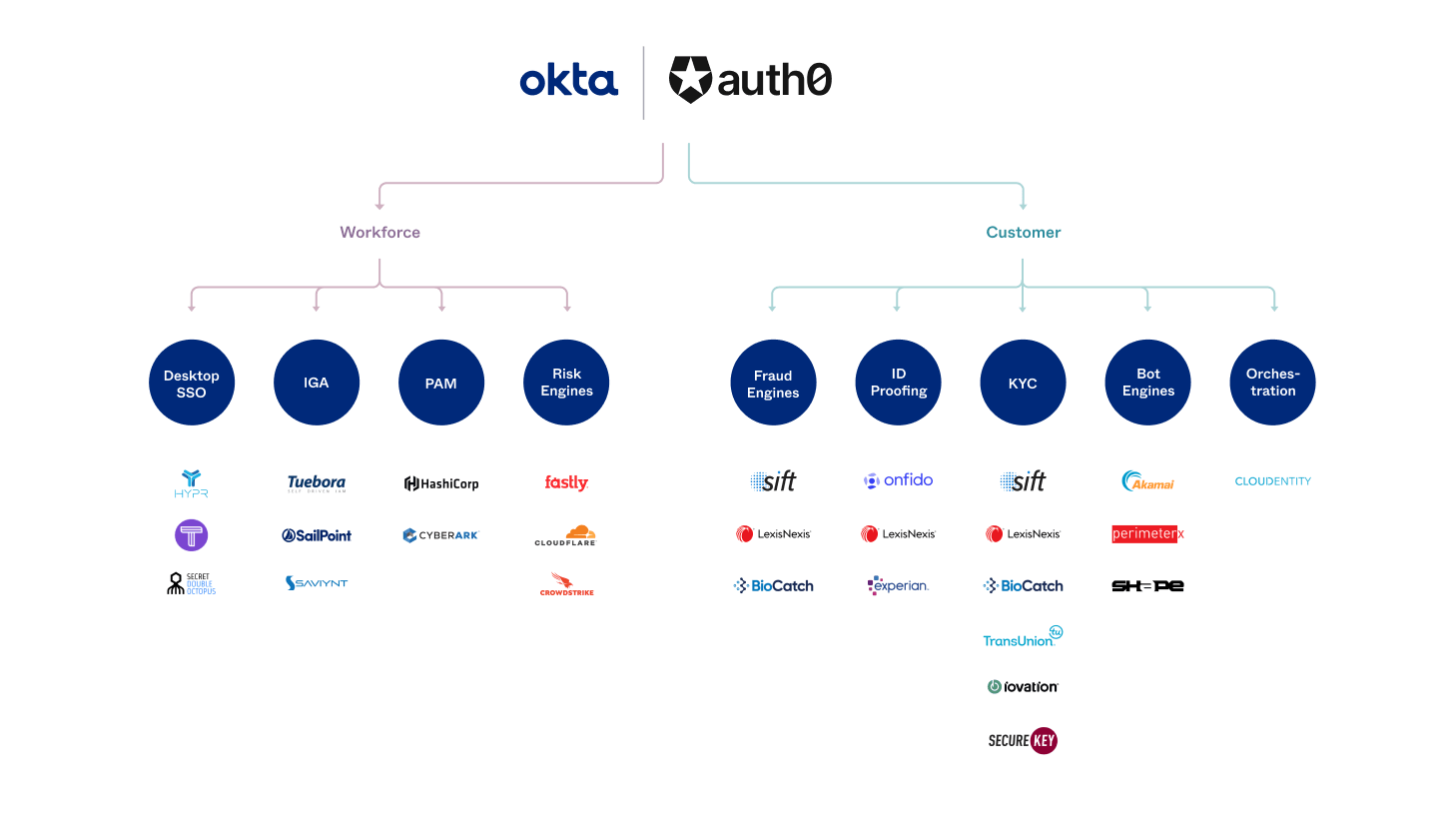

Get the power of choice

Connect with best-of-breed technologies that suit the needs of your financial services customers best. Reap the benefits of Okta’s vendor-neutral platform to easily implement the tools you use today, as well as tools you might want to use in the future.

Okta is the go-forward strategy for all authentication, and will be the single standard that we use. It will have a huge impact on everything we build going forward.

Barry Libenson

Chief Information Officer