An in-depth look into how organizations and people work today exploring employees, partners, contractors and customers, and the apps and services they use to be productive.

We released our first ever Businesses @ Work report in August 2015. Businesses @ Work uses Okta’s dataset of thousands of customers, applications, and integrations, and millions of daily logins to understand how organizations and the people who work for and with them get work done. In this report, we look at which apps, devices, and services businesses and their people (employees, contractors, partners, and customers) consume every day. Our data revealed some very interesting findings. We’re seeing traditional on-prem software companies successfully reinventing themselves in the cloud. We’re seeing enterprises continue to build out their library of applications with new and emerging apps. And, we’re discovering that no app, including email, is invincible.

How did Okta prepare this report?

Okta has the unique ability to see what’s happening in the cloud. For this report, we anonymized customer data from our network of thousands of applications, custom integrations, and enterprise customers and millions of daily authentications and verifications from countries around the world. Our customers and their employees, contractors, partners and customers use Okta to log in to devices, apps and services, and leverage security features to protect their sensitive data. Our customers span every industry and vary in size, from small businesses to enterprises with tens of thousands of employees.

What should I keep in mind while reading this report?

Because Okta is a cloud-first identity and mobility management company, Okta’s customers are likely to be more cloud- and mobile-friendly than your average business.

Highlights

The strangest of bedfellows: Office 365 and Google Apps complement each other in the enterprise. We’ve discovered that a surprising number of Okta customers across all industries are inviting both cloud giants—Office 365 and Google Apps—into their businesses. Our survey data showed that over forty percent of companies using both Google Apps and Office 365 do so because different departments prefer different applications, presumably for online collaboration. Thirty percent of overlapping customers use Office 365 for licensing desktop products (Excel, Word and PowerPoint) only and use Google Apps for day-to-day email and collaboration. As one respondent put it, “The easiest way for us to license Office and keep it updated is via Office 365.”

Slack is killing it, but it isn’t killing email—yet. Slack was the fastest growing cloud app amongst Okta customers in the second half of 2015, with a 77 percent increase in adoption. Slack CEO, Stewart Butterfield, claims that, “the whole spectrum of communication within a company can happen inside Slack”, leading many to wonder if it will eventually replace email. While email remains the most widely assigned app today, Slack is picking up speed...and fast. Slack is one of the most widely assigned apps in our network today.

You get an app! And you get an app! Everybody gets an app! As the digital revolution goes mainstream, every type of worker—not just the knowledge worker—is using cloud apps. While email has been the gateway to the cloud for many enterprises, Okta’s data shows that cloud apps are now taking on a wider range of more specialized roles for these companies. Developers, creative pros, engineers and HR teams are using niche cloud apps to meet their distinct needs and make them more productive and successful at work. Not only are companies using off-the-shelf “public cloud” services, as mainstream adoption of the cloud continues, custom apps that fill even more specialized needs are growing in our network as well.

After years of attempted transformation, old school software vendors are successfully kicking it in the cloud. The popularity of cloud apps has not been lost on traditional software leaders like Adobe, Microsoft, Oracle and SAP. In fact, Microsoft Office 365 extended its lead as most popular cloud app this year. Whether through internal development or via acquisition, these companies are re-inventing themselves in the cloud. Cloud application adoption within the Okta network from Adobe (Creative Cloud), SAP (Concur and SuccessFactors) and Microsoft (Office 365) grew 144, 133 and 116 percent respectively in 2015.

Enterprises are increasing their investment in security. With major breaches making headlines on a weekly basis, companies are continuing to increase their use of multi-factor authentication to secure their sensitive business information. Nearly one-third (30 percent) of companies are using multi-factor authentication in at least one app.

The digital revolution is here. For the first time, external identities have surpassed internal identities within Okta. According to IDG, 76 percent of IT decision makers say digital business initiatives to serve customers and partners are “very important” or “critical” in the next 12 months. And we’ve only scratched the surface. A recent report from McKinsey Global Institute says the US is operating at 18 percent of its digital potential. If the US fully realized the potential of digitization, this market could be worth $2 trillion dollars! While our data shows 80 percent of enterprises are building custom applications on their platforms, the average customer or partner is accessing five total applications via Okta. And, at least one off-the-shelf cloud app (Box, Jive, Salesforce, etc.) is being used by 83 percent of customers and partners today. The market opportunity here is tremendous.

The digital

revolution is here.

What are the most popular apps in Okta’s network?

Microsoft Office 365 continues to lead the pack as the most popular application, followed by Salesforce, Box and Google Apps. While these top four positions did not change since our 2015 Report, Microsoft Office 365’s lead has grown materially. We also see the emergence of Slack as one of the most deployed apps (number 12); it was not in the top 25 in our last report.

How many apps do organizations use?

Last year, we found that company size doesn’t play much of a role in the number of off-the-shelf cloud apps employees can access. According to our data, the sweet spot now lies somewhere between 10 and 16 apps, up about 20 percent from a year ago.

Why do enterprises use both Microsoft Office 365 and Google Apps?

Industries tend to favor Office 365 or Google Apps. The finance, biotech and construction industries are heavy users of Office 365, while Internet and marketing favor Google Apps.

But our data also shows a significant number of organizations using both products. And we wanted to know why. We surveyed overlapping customers and asked three questions:

- What do you use Office 365 for?

- What do you use Google Apps for?

- Why do you have both Google Apps and Office 365?

The most common reason for the overlapping products was that different departments use different apps. But that’s not the only reason. Over 30 percent of respondents said they are using Office 365 purely for desktop licensing purposes. As one respondent put it, “The easiest way for us to license Office and keep it updated is via Office 365.”

What are the fastest growing cloud apps in Okta’s network?

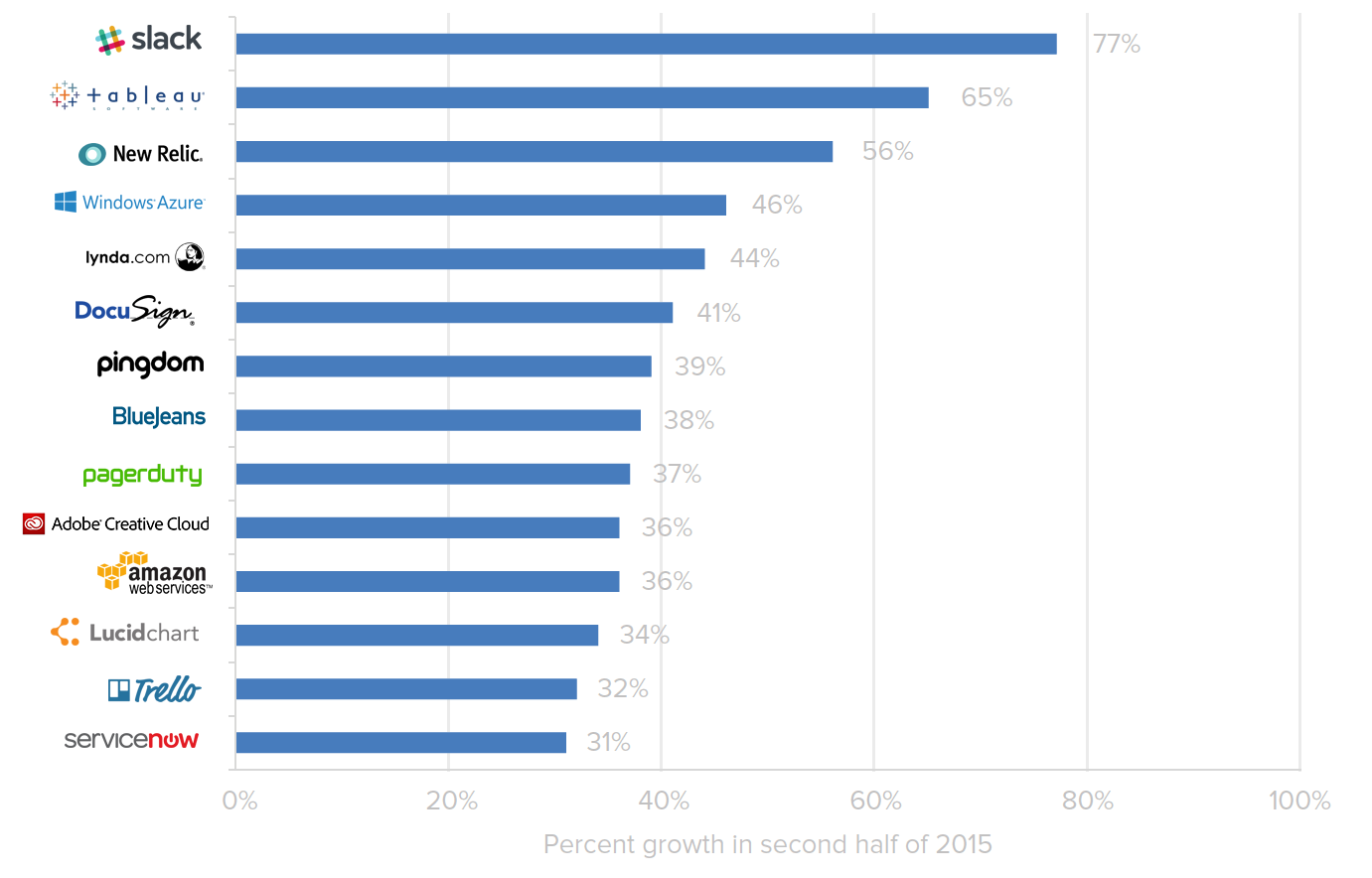

Companies of all sizes continue to adopt more median off-the-shelf cloud apps. And Slack in particular is taking the enterprise by storm! Slack remained the fastest growing app in the second half of 2015 with customer growth of 77 percent. Platform apps, New Relic and Windows Azure, were also among the fastest growing apps (56 percent and 46 percent growth respectively).

How widely are apps assigned by IT?

We were curious about cloud apps’ footprints across an organization, so we looked at how widely assigned some of our most popular apps are across our customers’ employee bases.

The apps on the far left are assigned to specific departments and teams within the enterprise. Amazon Web Services, DocuSign, Google Analytics, and New Relic all fit into this category. It’s interesting that Twitter and Facebook are positioned relatively close to one another in this section. We believe these apps still live outside of the IT realm.

On the other side of the chart, we see the cloud apps that are virtually ubiquitous throughout an enterprise. They’re the utility players. The apps on the far right include Google Apps, Office 365,Ulti-Pro, Concur…and Slack? Not only is Slack the fastest growing app within Okta orgs, but it is also one of the most widely assigned apps.

Are traditional software companies successfully reinventing themselves in the cloud?

Traditional on-prem software powerhouses like Microsoft, Adobe, SAP and Oracle have been making huge efforts to reinvent themselves in the cloud. And they aren’t shy about it at all! In his first letter to employees as CEO, Satya Nadella wrote, “Our job is to ensure Microsoft will thrive in a mobile and cloud-first world.”

The efforts of Microsoft and others are paying off. In the past year, adoption of Microsoft’s cloud applications (primarily Office 365) by Okta customers grew 116 percent. Adobe Creative Cloud grew 144 percent.

Other enterprises are taking a more acquisitive approach to becoming cloud-first. Some of the most successful cloud companies have been acquired by software giants like Oracle and SAP. Under new management, cloud apps are helping keep these businesses relevant. Concur and SuccessFactors extended SAP’s reach within Okta customers last year as cloud adoption grew 131 percent. Oracle adoption, with the help of Eloqua, Responsys and Taleo acquisitions, grew 68 percent.

Which industries are using what kinds of apps?

When it comes to deploying cloud apps and managing them with Okta, every industry is different. As you might expect, software and Internet services are at the forefront of cloud adoption. Others like finance, healthcare and education are lagging behind.

Which regions are using what kinds of apps?

Apps managed by Okta, such as mail, marketing, and social media are well-represented geographically. Document storage is also seeing significant (greater than 50 percent) penetration across geographies. Other categories vary dramatically by region. HR apps, for example, have significant penetration in North American companies (more than 50 percent) with less than 25 percent adoption in EMEA and Asia Pacific. Other lagging categories outside North America include video conferencing and expense management.

App surge or lag depends on a number of factors. We believe cultural differences, varying regulatory environments, market maturity and vendor expansion strategies are all playing a role in adoption cycles.

How does external identity growth compare to internal?

According to Harvard Business Review, “ just about every individual, company and sector of the economy now has access to digital technologies—there are hardly any ‘have nots’ anymore.” And, enterprises are taking advantage of this digitized world. In 2015, external identities grew by 488 percent compared to internal growth of 138 percent. And, for the first time, total external Okta identities surpassed internal. We’re just scratching the surface today. HBR estimates that “if the U.S. were to capture the full potential of digitization, [it] could be worth at least $2 trillion dollars to the economy.” Businesses know that a good web and mobile experience increases business agility and productivity, and they are moving on it. Needless to say, we expect this trend to continue.

Build versus buy for platform?

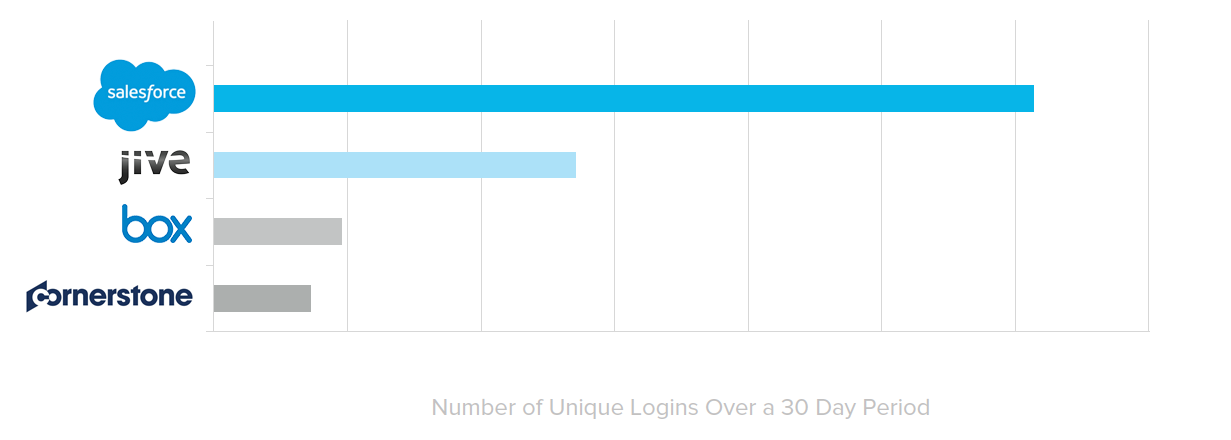

The answer is both. On average, external users (customers, partners, suppliers, etc.) access five apps via the Okta Platform. While 80 percent of enterprises are using custom integrations for customers and partners, we’re noticing that enterprises don’t want to reinvent the wheel. More than 80% of external customers are leveraging at least one off-the-shelf apps like Salesforce, Jive and Box.

What are the most popular security policies in Okta’s network?

It’s no surprise: security is paramount to enterprises. But businesses are choosing a variety of ways to secure their environments. Ninety percent of Okta customers have at least one SAML-enabled application today. Forty percent of organizations have enabled automated deprovisioning. Roughly 30 percent of customers have multi-factor authentication (MFA).

According to TechCrunch “whatever’s destined to substitute passwords will have to be simple, robust, affordable and flexible enough to convince billions of users to change one of their oldest computing habits, and be secure and unbreakable enough to convince hackers to try their luck elsewhere.”

What are the most popular factors of authentication across Okta’s network?

The most popular form of MFA remains the security question, followed by SMS authentication but, as we revealed in our last report, both are on the decline in favor of other factors. Among those, while nothing has emerged as an obvious trend, one thing is clear: the fastest growing factors are those focused on end user experience.

Enterprises are more focused than ever on securing corporate data outside the firewall, but they also don’t want to slow their end-users down with cumbersome second factors. We anticipate this trend to continue.