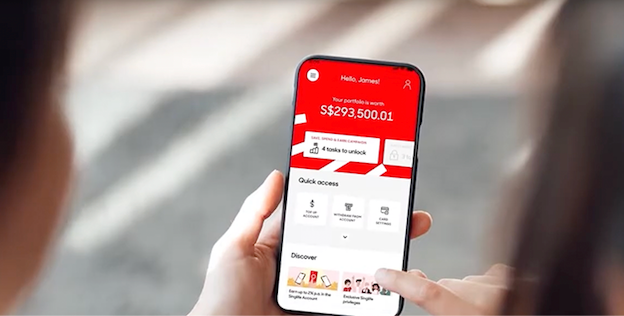

Xactly reduces identity sprawl and drives fast remediation with Identity Security Posture Management

Customers

Top brands trust Okta

We make customers successful by enabling them to securely use the best technologies for their business.

Explore our customer stories

All

•

Sort By