The Year of the Tech IPO: Exploring App Growth in the Okta Integration Network

For years, the business world has awaited the public market debut of the most talked about companies in tech. Enterprise and consumer heavyweights like Zoom, Lyft and Pinterest have already gone public this year, and more are expected to file in the coming months.

At Okta, we connect our customers to the apps many of these newly- or soon-to-be-public companies provide — in fact, we offer over 6,000 pre-built integrations to applications and IT infrastructure providers. Our expansive Okta Integration Network (OIN) gives us unique visibility into the apps people are using in their day-to-day work lives. So we asked ourselves, how have this year’s IPO darlings and contenders performed across Okta’s global customer base compared to last year’s IPOs? We dug into our data to find out, focusing on companies with a strong enterprise offering — like Zoom, Slack, PagerDuty, Cloudflare, DocuSign, Dropbox and ZScaler. Here’s what we found.

Zoom is a clear winner for 2019, with Slack following right behind

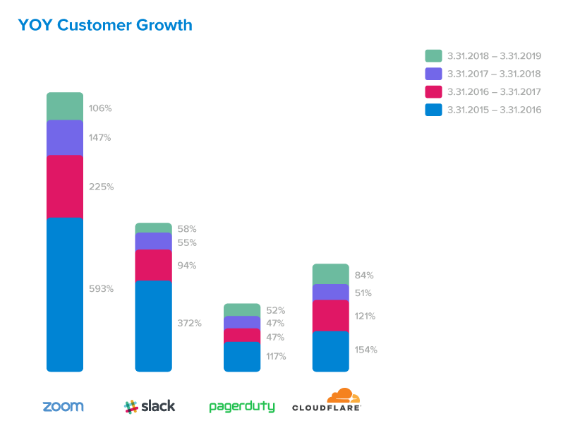

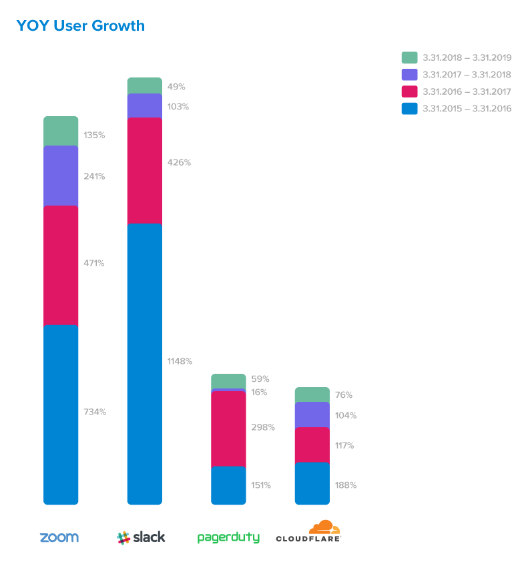

When it comes to user and customer growth, Zoom takes the cake. Between March 31, 2018 and March 31, 2019, Zoom’s customer growth increased by 106%, and its user growth increased by 135% across Okta’s customer base. Slack grew at half the rate during the same time period, but don’t feel bad for them. The company saw quadruple-digit user growth in 2016 across Okta’s customer base and has continued to rapidly expand ever since. While Cloudflare hasn’t filed yet, its track record of growth in our network may make it another IPO contender.

With user and customer growth data, it’s fairly common to see the percentage of annual growth decrease from one year to the next. This makes sense: as companies grow, each new user or customer represents a smaller percentage of the total. One interesting takeaway is that all four companies we analyzed saw massive growth spurts 3-4 years ago. In fact, Zoom was crowned the fastest growing app in the Okta Integration Network in 2017, and Slack received the same honor in 2016. This may be a clue for identifying the next generation of IPOs. In 2018, we reported that Jamf was the fastest growing app, with 389% growth across our customer base. KnowBe4 saw 290% growth that same year and proceeded to take the top spot for growth in our 2019 report, indicating that Jamf and KnowBe4 will be companies to watch over the next couple of years.

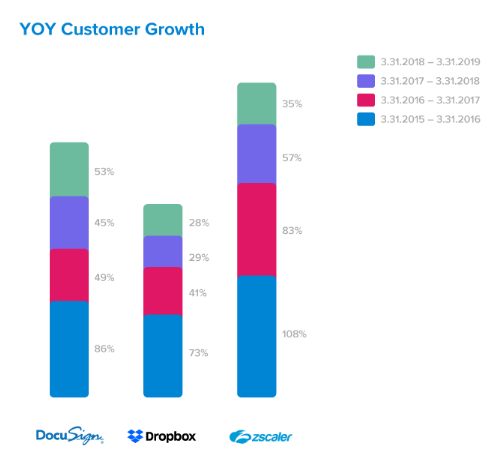

2019 IPOs have seen stronger, longer growth than predecessors

When we compare the YoY growth for companies that went public in 2018 to companies that have filed (or may file) for an IPO in 2019, an interesting trend emerges. Over the past several years, the four companies we analyzed — Zoom, Slack, PagerDuty and Cloudflare — saw higher average annual growth across Okta’s customer base. The average customer growth rate between 2016-2019 was 145% for the companies that filed (or in Cloudflare’s case, are rumored to file) for an IPO in 2019, compared to 56% for the three companies we analyzed that went public in 2018.

You went public, now what?

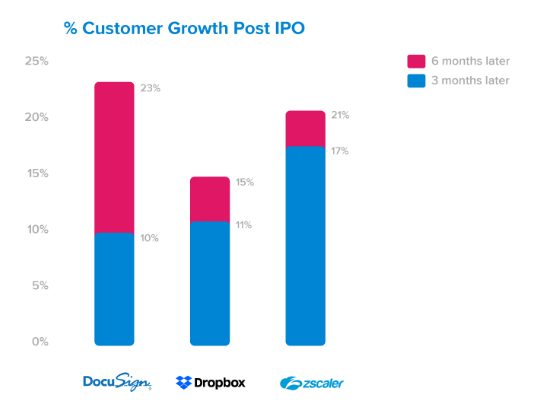

Within six months of DocuSign’s IPO, its Okta customer base grew by 23%. Zscaler’s customer base within the Okta network grew 21% within that same time frame, and Dropbox saw 15% growth.

All of this IPO talk brings me back to when we took Okta public in 2017. Ringing that opening bell is a huge milestone, but it’s also just the beginning. After all, who wants to peak in high school? I recently spoke to five founders about their experience going public and you can listen to what they had to say on our Zero to IPO podcast. But to me, one of the most important ingredients for being a public company is predictability, both on the upside and the downside. The SaaS model worked in Okta’s favor following our IPO, and it will be interesting to see how this year’s crop of IPO companies ensure predictable growth.

For more information about how apps are performing across Okta’s global customer base, check out this year’s Businesses @ Work report. See “How Did Okta Create This Report?” for more details on the source of the data used here.