Best-of-Breed vs. Suites: Growth of Slack and Zoom Across the Okta Integration Network

By now you’ve likely heard the debate about the growth and adoption of Microsoft Teams vs. Slack. We wanted to bring a different perspective to this conversation based on the trends we're seeing across our network of thousands of companies, applications, and technology integrations, and millions of daily authentications and verifications.

As the enterprise software ecosystem grows and becomes more heterogeneous, CIOs and CSOs are looking for the best applications to support their workforces and increase efficiency, all while maintaining control and security. The success of best-of-breed apps has led to a number of successful IPOs over the past few years, yet software giants continue to argue that their all-in-one solutions negate the purpose of specialized apps like Slack and Zoom. But, as I recently discussed, it’s hard to do many things very well.

Okta’s data shows suites vs. best-of-breed is hardly a David vs. Goliath story. Because we connect our customers to the technologies they use in their day-to-day work lives, our Okta Integration Network (OIN) gives us unique visibility into the adoption of best-of-breed applications and their monolithic competitors. We dug into the data and found that organizations are increasingly deploying best-of-breed apps alongside suites, and that adoption of best-of-breed is growing much faster.

Best-of-breed and software suites go hand in hand

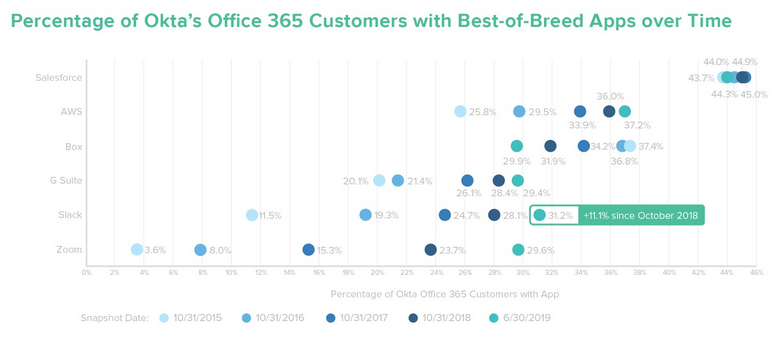

Our 2019 Businesses @ Work report shows that Office 365, Box, G-Suite, Salesforce, AWS, Slack, and Zoom are seven of the top 10 most popular apps in the enterprise. So the question became, “Do Office 365 customers go all in on Microsoft's offerings?” As of January 2019, the answer was resoundingly no. Customers are increasingly implementing best-of-breed apps, which, in many cases, overlap with Microsoft’s embedded offerings.

As of this June, more than 77% of Okta’s customers with Office 365 had also adopted best-of-breed apps, such as Slack, Zoom, Box, AWS, Salesforce or G-Suite, and these numbers have been steadily growing. Between October 31, 2018 and June 30, 2019, Zoom saw a whopping 25% increase in Office 365 customers adopting its solution, the most of any best-of-breed app we analyzed within Okta’s customer base. Slack’s growth among our Office 365 customers was also in double-digit territory, up 11% to 31%, which indicates the race is on for collaboration apps in the enterprise.

Users clearly love Zoom and Slack

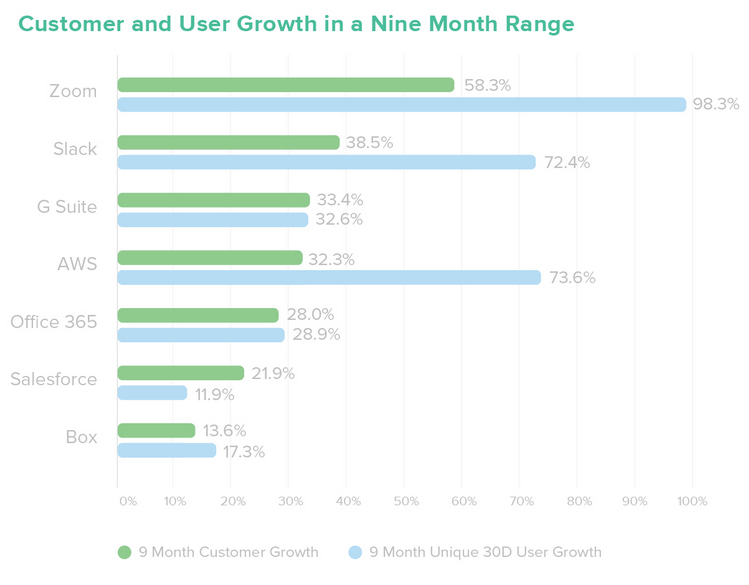

Best-of-breed apps are growing in popularity, with their user base outpacing their customer acquisition. Over the past nine months, the percentage of Okta’s customer base adopting Zoom grew 58%, and its unique users grew 98% across our network. In the same period, Slack has grown 39% in terms of customers, and boasts a 72% increase in unique users. Meanwhile, Office 365’s customer and user growth numbers both hover around the 28% mark.

We can draw two conclusions from these findings: first, customers are successfully deploying Zoom and Slack to their employee base. Active users are what really matter when evaluating app traction; it’s not enough just to look at the number of licenses for each app, as these can be packaged for free within other software suite bundles.

Second, once customers adopt a best-of-breed app like Slack or Zoom, they tend to see strong adoption across their organizations. What may have started as a tool used by a marketing or engineering team becomes a core app for all teams across the organization to collaborate and improve productivity. And with independent solutions, it's easy for organizations to get the benefits of popular standalone apps without being locked into one provider.

Organizations are evolving and need tools that accommodate an increasingly specialized, distributed and collaborative workforce. Software bundles just aren’t cutting it, and customers are looking to supplement their suite offerings with apps that focus on perfecting a narrow purpose. Our user data indicates that the workforce is responding positively, flocking to best-of-breed apps in droves.

How did Okta source this data?

To source the data reported here, we anonymize Okta customer data from our network of thousands of companies, applications, and IT infrastructure integrations, and millions of daily authentications and verifications from countries around the world. Our customers and their employees, contractors, partners, and customers use Okta to log in to devices, apps and services, and leverage security features to protect their sensitive data. Our customers span every major industry and vary in size, from small businesses to enterprises with hundreds of thousands of employees or millions of customers. Keep in mind that this data is representative of Okta's customers, the applications we connect to, and the ways in which users access these applications through our service. Unless otherwise noted, this report presents and analyzes data from October 31, 2018 and June 30, 2019.

For more information about how apps are performing across Okta’s global customer base, check out this year’s Businesses @ Work report.