2019 in IPOs: Which Software Stars Made the Cut?

Last May, I shared my thoughts on the IPO landscape. At the time, the business world was anxiously watching and awaiting the public market debut of some of the biggest names in tech—it was the “year of the tech IPO.” Throughout the second half of 2019, we saw many tech companies successfully go public, but we also saw many offerings fail to meet expectations (and others not even make it to market). A shockwave rippled across the industry and our outlook on the IPO landscape shifted, leaving us wondering which companies would rise to the top in 2020, and what we can expect from new public debuts this year.

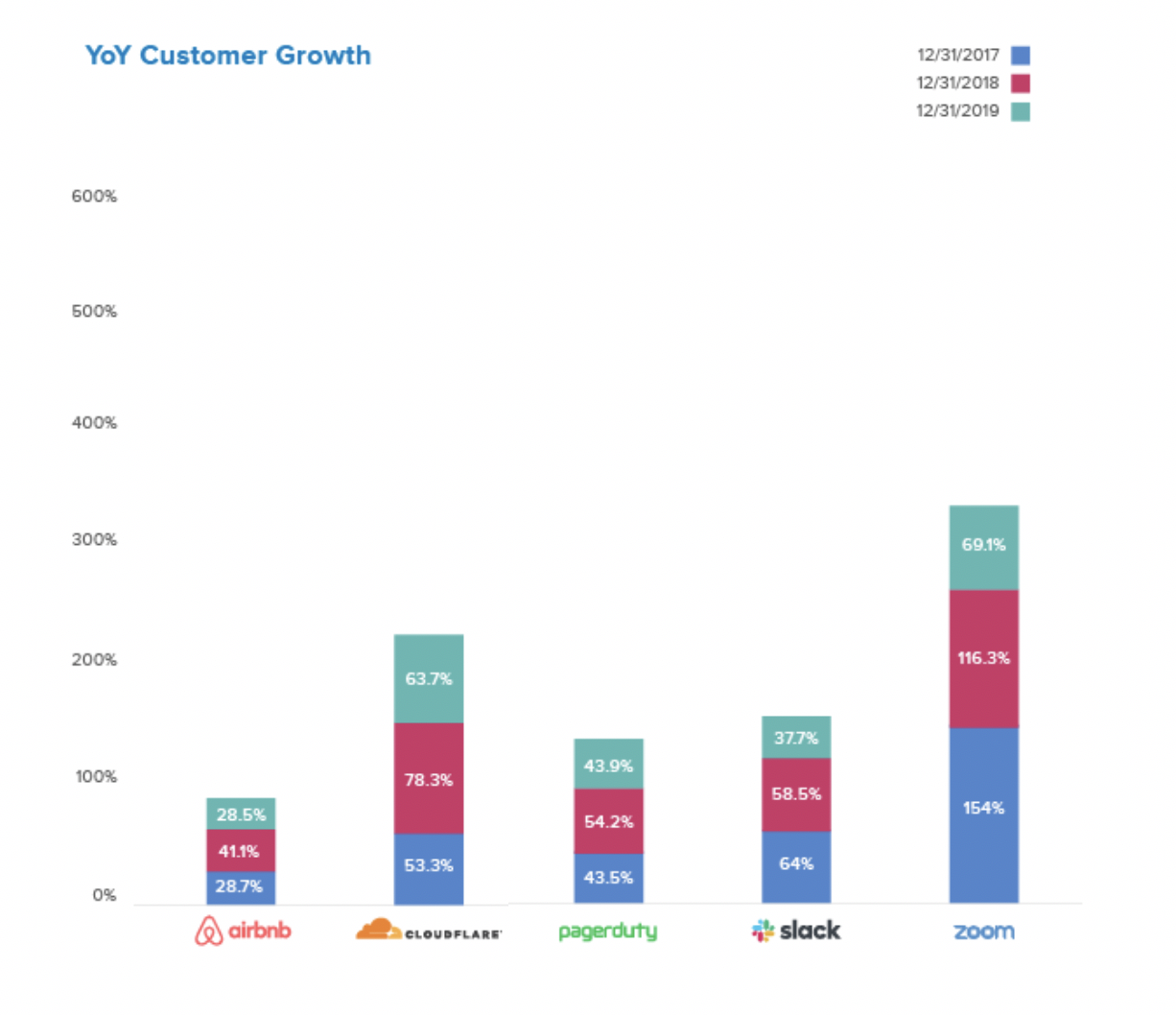

To dig in deeper, we turned to our Okta Integration Network (OIN) for a glimpse into the performance of many newly- or soon-to-be-public companies. Which ones grew the fastest, which showed consistent momentum, and how were businesses faring after going public? We looked at app popularity across the OIN (both those deployed by IT and personal apps adopted by employees) in two different ways: first, through the number of customers with an app deployed, and second by the number of app users. We focused on companies with a strong enterprise offering — like Zoom, Slack, PagerDuty, Airbnb, and Cloudflare — to survey the landscape and help predict what’s next. Here’s what we found:

Airbnb checks in as IPO contender with consistent user growth

Since its inception in 2008, this online marketplace for arranging and offering lodging has had a massive impact on the way we travel and experience destinations. Over the past three years, we’ve seen impressive growth for this IPO-contender. Last year, Airbnb experienced 48.1% year-over-year user growth—a jump up from 45.8% in 2018 and an increase from 17% in 2017, within the OIN. Airbnb for Work, the company’s B2B offering, may be fueling some of this growth over the past few years; in late 2018, the company noted the business arm accounted for 15 percent of its overall bookings. This consistent user growth sets the company up as a likely hot IPO of 2020.

Other companies on the rise? Zoom came in first place at 110.5% user growth in 2019 in the OIN, down from 189.9% in 2018 and 99.5% the year before. Cloudflare also showed a pattern of deceleration, coming in at 24.2% this year, down from 64.4% in 2018 and 110.8% in 2017. Cloudflare and Zoom both went public this past year, so this deceleration pattern across high-growth companies may indicate user numbers can spike in the period just before the IPO. As these businesses scale, they tend to even out and maintain steady growth as they get their feet on the ground as public companies working towards profitability.

Two $10 billion software companies join the public market

This year, we witnessed two cloud software companies in the 11-digit club debut on the public market in 2019: Slack and Zoom. While investors might have had questions about cash-burning IPOs like Uber and WeWork, they showed interest in cloud companies that promised sound financials and a path to profitability. In the wake of the rocky IPO scene of 2019, businesses with high customer retention rates lead the way. Our data confirms the rise of these enterprise stars over the past three years: both companies experienced YoY customer growth since 2016. Zoom was in the lead: between 2016 to 2019, their customer growth spiked up by 829% on the OIN.

Sustaining growth is hard, but these companies do it well

Keeping momentum alive after an IPO is not easy. When the champagne stops flowing, leaders often find their responsibilities change or increase as business strategies and goals shift. To avoid “peaking in high school” (yes, high school graduation is my favorite analogy for the IPO process), it’s critical to see the IPO as a stepping stone versus an end-goal.

To see how the companies we analyzed fared after going public, we took a look at customer growth in the OIN three months following the IPO. What did we find? Growth stayed consistent across the board, meaning these leaders are doing it right. We went further out for those that went public earlier last year and found Zoom, PagerDuty, and Slack all had a growing number of customers six months out, too. Zoom had the highest customer count from the IPO date, showing 28.9% customer growth six months out, and PagerDuty followed at 20.1%, with Slack being third at 15.3%.

I often say “it’s not about going public; it’s about being public.” Only by playing the long game can you create long-term value for customers. The IPO is a significant milestone, but it’s what happens after that defines your success as a sustainable business. I’m looking forward to watching the continued growth of this year’s crop of IPO companies, and looking out for the next wave of tech stars.

For more information about how apps are performing across Okta’s global customer base, check out last year’s Businesses @ Work report. Scroll down to “How Did Okta Create This Report?” for more details on the source of the data used here.