Motorists Insurance: Managing the Entire User Experience from External Portals to Internal Compliance

Transcript

Details

Tony DeAngelo:As she said, I'm Tony DeAngelo. I was asked to share our customer journey at Motorist, which is, I think, very different than some of the other talks that you might have heard. A lot of the talks are focused more on integrating Office365 or integrating SAP. We really integrated a company and took a very different approach on our path to digital transformation. And I think you're going to see that a lot of the same themes from earlier talks in earlier keynotes really kind of resonate through, our story, very much anchored in digital transformation, business transformation, leading with identity, modernizing IT, lot of those themes that have been emphasized throughout the conference so far. So a quick agenda, just a little context around who we are, defining our problem and then the strategy and solution that we came up with to move our story forward. A little bit about me. I've been with Motorist since 2004. I'm responsible for the entire integration or execution of the information security program for our enterprise. I've got a small team, a of 12 and where we cover a lot of breadth.

So getting into Motorist and who we are, Motorist is an independent agent based Midwest regional carrier. So we don't do direct sales, we don't do any direct to consumer, it's all based on that relationship with the independent agent, offering personal lines, commercial lines, work comp and life insurance solutions. We are a mutual company so we're not publicly traded, but what that means is that we grow through affiliations So, over the years the group has grown tremendously. You can see the group is now 16 companies, and the primary brands are down there, with the logos. Independent agents being the lifeblood of our business. And what makes them so important is the fact that it's kind of a best of breed approach from a business perspective. We focus on offering the best insurance products, providing claims, policy billing. The agent focuses on selling those products. So, our primary customer is that independent agent, right? It's all built on that relationship.

Getting into defining our problem. Going back several years, the independent agents had a very, say impersonal, disjointed view of the business, right? So if you were an independent agent and you were doing business with us, you had a different account per line of business per company, per agency. So if you're an agent representing Iowa Mutual and Motorists Life, that's two accounts. If you are doing that across three agencies, that's just exponentially growing that number of accounts that you've got to manage and account for, right? So it grew very disjointed, no single view of the Motorist offerings. Every company had its own portal. Everything was, you know, that impersonal, disjointed view. So if you're an agent trying to sell a policy to a business owner, you're logging in and out of different portals that you're trying to show different offerings.

This gets into our legacy structure and getting back to the fact that we do grow through affiliations. Every affiliation brought its own technical debt. So we kind of refer to this as the spaghetti slide. This is the old infrastructure and its multiple redundant systems and multiple integrations and multiple layers. That just adds up to that more and more complexity, right? So different systems, different interfaces, different look and feel, further complicating the whole scenario for the agents and also from an IT perspective, right? More systems, more redundant, the harder to uplift, the harder to maintain, harder to administrate.

So this is where we start getting into kind of recognizing the issue in defining our path forward. You know, obviously agents growing increasingly unhappy, frustration of dealing with multiple portals. You've got different disrupters in the industry. It's a very competitive market, lots of choices in insurance, you've got insure tech companies spinning up, you've got lots of different options and those agents being independent, they control where they want to do business. So it's very important that we've got a good relationship and a good experience for them. You also get into, you know, retention, right? So if an agent has a bad experience, then there's nothing to keep them anchored there. They can take their book of business and go to a competitor. So it's really focusing on that, improving that relationship and increasing the customer experience that's really important.

And at the same time that this was ... we were coming to this realization, our CEO, Dave Kaufman, also was coming into his new position and he really created the anchor for us to move forward. He went off and defined a 10 year vision for where he wanted the company to go. And that vision was very transformational for us. So Motorist being a mainframe based insurance company, you know, we had lots of legacy systems, lots of old practices, lots of kind of stale thinking, so to speak. They really wanted to flip that on its head and really wanted to see it back to being more of an innovative company, take a much more innovative approach, really getting into cloud first, mobile first, you know, transforming the business, doing a lot of those things that we're hearing about now. This was several years ago. Dave's vision really led to ... From that one vision we defined five strategic directions which led to 40 strategies that led to 380-some objective teams and that whole framework created this path forward. And that's what's really, I think different about our story is we obviously didn't launch 380 objective teams at the same time, but we did launch several objective teams in parallel, really moving this whole culture forward.

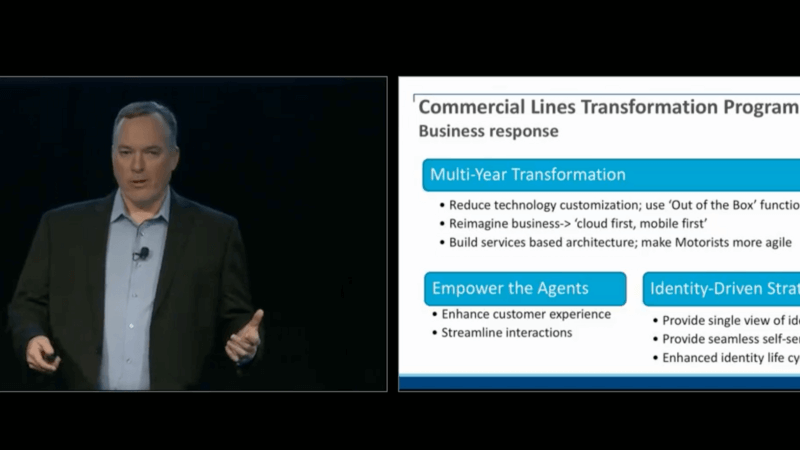

So it was really about breaking down the culture, getting to be more collaborative thinking, innovatively, being willing to make mistakes, and getting to a point where we're really ingraining that continuous improvement mentality going forward. So obviously change was needed at the time and from that vision and from all those strategies that were defined, one of the main transformations from a technology perspective was our commercial lines transformation program. So it was a multi-year transformation process and it was really anchored in creating a new company. So, you know, looking at the past and seeing where we were and really trying to change all of the things that the agents were going through, really modernizing the whole approach, not just the technology but the business and the customer experience. So you get into a reducing that technology customization, getting back to an out of the box, straightforward implementation. We were very heavily customized in the past, re-imagining the business. In Dave's version, he really emphasized cloud first, mobile first. When we started down this process, cloud was really a dirty word for us. We were totally entrenched in on prem. We're going to put our arms around our technology and really manage it ourselves and we really didn't have any trust of the cloud.

Dave challenged that and really said, you know, the future is cloud. The future is going to be much more mobile. Our agents want to have a much better experience. We need to embrace it. And also getting back, getting back to more of a service-based architecture, right? We needed to be much more nimble, much more agile as a company, having all those legacy systems, not being able to uplift, having those upgrade projects take years to implement really slowed down our ability to process anything going forward.

And then you get into empowering the agents, right? The whole core of what we're trying to do is give them a better customer experience, streamline those interactions. And this is where identity really started to come to light for us. We started to realize that identity wasn't just a collection of accounts. It's really getting at that person, right? Identifying identity as that agent and all the attributes that make up that person. So it's getting into more of a providing that single experience, creating that seamless self-service, right? At the point where we were defining this, agents had to pick up the phone and call a help desk for everything. We needed to provide them self-service. Let them do, take on some of that support burden. Let them work at two in the morning if they want to, and reset their password instead of being anchored to a phone call to a service desk that's working, you know, traditional business hours and then just generally enhancing that whole lifecycle management.

So you can imagine onboarding a new agent was a difficult process. You had to figure out which agencies they were on, what companies they were representing, process all that manually. We were very manual based, so somebody had to sit down at a keyboard and bang out all those accounts and make all that happen. We needed to greatly enhance that whole process, get more automation and orchestration going. So that really led to defining the commercial lines, what we refer to as a transformation project program. So the program was at a strategy level. It was made up of several objectives and objective teams right? So, it was anchored in the whole idea of creating a new commercial lines company, right? Taking a total green field approach and really changing the paradigm of how we do business. It's all anchored as Guidewire is our core backend system, replacing policy, billing and claims, getting rid of that spaghetti slide and really streamlining the organization through one core set of applications.

And then we achieve this through a cross functional teaming. Right? This wasn't just an IT project, it wasn't just a business project, it was really bringing both sides together and through heavy collaboration and forming these objective teams with business people and IT people and customer experience and marketing and everyone at the same table at the same time, getting all those voices heard, so that we could really get at the core of identifying and addressing the business problems and challenges and then mapping out those business processes so that we can enable them with technology instead of trying to just make the technology work.

PwC was our identified ... they were identified as our Guidewire integrator. And then that turned into a much broader relationship where they helped drive some of the digital transformation. Brought that industry thinking. Really helped break us out of our mold and helped to stand up this whole process, of this transformation program. Also brought ... at that point, cloud being a dirty word for us. They brought that experience with Okta, with SailPoint, with some others, and really helped us drive that forward. So then we get into ... This is where Okta starts coming to light for us, our digital transformation is really anchored back into a Dave's vision process, right? Which is overhauling the business processes, really changing this company strategies and getting into that corporate culture. And you can see, kind of go around the circle there. You've got the new co is what we kind of internally branded it, but the new commercial lines company that really gets into, you know, Okta providing identity focused approach for us as the ... As we stand up that company and start laying out the architecture for what's going to be there. Agents would have a new single, seamless experience through a single account. Establishing the new company culture is really getting into buying into innovation, being willing to make mistakes. As you can imagine building a commercial lines company from the ground up is a huge undertaking, right? Lots of work efforts happening in parallel, both on the business side and the technology side. We had to be willing to make mistakes, identify those mistakes, pivot and overcome, all right, and find new ways to do things. You've really got ... And then that's also where we get into really getting the culture shift of embracing continuous improvement and innovation and willingness to make mistakes and those things. It's really it being in line with that cloud-first, mobile-first mentality.

Then as you go down to providing leading user experience, it's really from the transformation program perspective, we wanted to have the same experience across all our customers, so internal associates, agents, policyholders, everybody should have the same experience. In the past it was all disjointed. Everybody had something different, different experiences across different companies, different experience internal and external. We needed to streamline that so that everyone's having that same good experience go forward.

And then you get into embracing new operational objectives. That really gets into establishing that environment where agents can focus on business, right? In the past you've got five or six accounts you're trying to manage. You don't want to be dealing with the frustration of one of those accounts is expired, you forget the password for another account, having to go through and try to sort that out. We needed to get down to simplifying that experience for the agents, right? Get to one account, provide them self-service, get to a point where they can focus on selling insurance and we can focus on maintaining the technology for them. That's really where Okta provides that seamless experience for us, and we got a lot of improved efficiencies out of that. This is a high level view of the architecture. You can see you've got the insurance agents interacting through Okta. Okta really took care of all the front end identity for us. It's authentication, it's authorization, it's single sign-on, it's ... We use session management and generating SAML tokens, which really empowered our integration approach. But as those agents are going through the external portal, all that's integrated through Okta, Okta's integrated with f5, and f5's powering all the back-end integrations that we had.

We've got a best-of-breed approach here, where we're leveraging the strengths of Okta for identity, but we've also go SailPoint On-Prem doing provisioning, deprovisioning, and governance, and really getting the best of both there, along with Guidewire is focused on providing policy-building and claims data. Then we've got MuleSoft, where we're getting back to providing that services architecture, right? We've got API integration with MuleSoft. MuleSoft is our enterprise service bus powering all those back-end workflows and processes that it takes to actually execute the business. All that is now a stream less, straight-through process for the agent. They're not logging in and out of systems anymore. They're logging into a portal once. They're having a much better, much more streamlined experience because of that focus on identity with Ooktkta up front. This is just kind of reinforcing that, right? The benefits of our commercial lines approach, focusing on identity gets us to that one, seamless account for the agents, right? No more of the disjointed approach, able to bring together those composite agents or the agents across multiple agencies as one identity, right? It's more personal, more tailored. We're able to do new things where the business can provide streamlined responses through the portal, because we know who the identity is. We can manage that identity. No more shared accounts. Some of the agencies had so many accounts to manage they ended up using shared accounts across agents.

With the self-service capabilities, we're now empowering the agents to do their own password resets. No more phone calls to the help desk. Then you've got improved security overall, because we're removing those extra accounts. We're reducing that password sprawl. We've got better streamlined approach, where we know what to expect. Everyone's coming through the same channel, and we can provide better service, better security, and streamlined approach.

Obviously, that turns into reduced frustrations for the agents, much better experience, right? Driving that whole business relationship back in a much more positive direction. Fewer support calls and that's again the streamlined efficiency, right? This is another view of the architecture at a high level. By using Okta as our IDP or our identity provider, we're able ... This view is really around tokenizing that identity. When the agent interacts and logs into the web portal, and they get authenticated, we're able to reach into Active Directory, where we store those agent accounts, and grab group membership that drives unique attributes for those agents. Encapsulate that into a SAML token that's passed into the backend, and then that token then, through f5, is interacting with the backend services, and we're able to track the identity through that tokenization process. Much better than having an agent log in and out with separate accounts. Much easier to manage. It's group-membership-based, instead of custom attributes and custom scripts. It's much more scalable and sustainable.

Going from the spaghetti slide, we end up with a slide that's much cleaner, a much cleaner infrastructure, a much cleaner approach, much easier to maintain, a much more direct, right? You can see some of the key Okta integrations there that enable that. We had Okta and Episerver, which was our web portal in the cloud, so you have the portal authentication session management happening there, you have F5 integration that really empowered the SAML tokenization, and then we had MuleSoft with a API integration for the seamless workflow on the backend.

That led to, obviously, much greater, improved agent satisfaction. Going back to Dave's vision and the focus on customer experience, we actually created Voice of the Customer advocates. We had a whole team that goes out and reaches out to the agents for continuous feedback, continuous conversation, really get that voice of the customer into the business. You can see through some of the quotes there, you've got agents that are much happier, much more willing to conduct business, because of the improvements in that experience that they were provided Then with the focus on customer experience, we actually started tracking a scorecard for what the effort was to interact with the company. We'd never done that before, so we don't have a before and after to compare it to, but now, at least, we can go through that continuous improvement and continuously try to drive that number down and make that experience better and better over time.

Up until now, all that has been focused on our primary customer, the agent. In the past, we were never able to provide policyholders with a tailored portal for themselves, sorry. Now that we have the Okta architecture and the backend integrations, we're able to leverage that same architecture to move it forward and create a customer portal or a policyholder portal and actually enhance the agents' ability to conduct business. Leveraging Okta again, and that whole self-service customer experience, seamless experience process, all those critical success factors that we had defined earlier, we're able to use that, leverage that, and then instead of having all those policyholders log in and create accounts into our internal, on-prem AD, we have them go through a self-service process, where they create accounts, and those accounts are stored in Okta's universal directory.

Now we're getting better management, better experience, and we're able to offer options to our customers that we were never able to provide in the past, offloading some of that support burden from the agent. Now a policyholder doesn't have to call our agent and request information that the agent then has to go and retrieve and forward out. They can go and get some of that for themselves. They can do more support. It's more of a modern experience and meets the expectations of the policyholder, along with the modernizing of IT. Additionally, at the same time we were going through launching this commercial lines company, business continued. We were also going through an affiliation process with a new member of the group, BrickStreet Mutual. At the same time we launched Motorists Insurance, which is the new commercial lines company, we were affiliating with BrickStreet Mutual. In the past, those affiliations and onboarding new companies would take years, right? We're bringing in all those older systems, we're creating more technical debt, we're trying to find ways to integrate all those systems. When we affiliated with BrickStreet, using Okta, we were able to bridge both Active Directories and start going down the path of integrating enterprise-wide solutions at a much faster rate.

We were able to bring Workday into the organization over a few months instead of the years it would have taken in the past. We've got Workday, we've got ServiceNow, we've got Office 365. We've got a whole collection of apps behind that that we've been able to provide to the entire enterprise, even though we're still working through some of the core transition items of the affiliation. So much quicker speed to market, much quicker enablement of the business, and a much better experience for the internal associates. Much more scalable, single-source for identities, and really getting at the business to business, the business to consumer, and then the internal associates. Through this whole process, and kind of looping back into the strategies for the commercial lines company and the transformation, one of our objectives was to really overhaul our approach to identity access management. That's one of our disciplines within the information security team. What we had in the past was very much a patchwork of legacy capabilities, right?

Like I said in the beginning, we were really managing a collection of accounts, not really managing identities. Going forward, we're able to kind of take that best-of-breed approach, take Okta, focus it on authentication, SSL, SAML, MFA going forward, leverage SailPoint with its strengths of provisioning and compliance, and then CyberArk for privilege access management. By using these three, we were able to really get at a strategic alignment with the integrations between the companies and then between the integrations that those companies provide to other platforms within the enterprise. It's really, each one of those companies brings their own capabilities and roadmaps. As we saw this morning in the keynote, Okta's got continuous improvement that just continues to provide value there for us. All of them are in line with that cloud-first, mobile-first mentality, and it's really, the key point here is that Okta has really enabled us to be, as an information security team, has really enabled us to be enablers. In the past, we're always trying to overcome that stigma of security being a roadblock. With Okta, we've been able to implement apps much quicker. Okta is seen less as a security control and more as a convenience, we're really able to drive that experience. So the business is much more receptive, our associates are happier, our agents are happier. And now we've even been able to extend that out to policyholders. So just to kind of summarize, you know, when we started this and we've started going through the vision process and strategies, defined a lot of key business differentiators and success drivers that we wanted to achieve, not for a specific technology or process, but for the company as a whole. So we started getting into this, we saw the value of Okta start ticking off lots of different boxes and you can see here, right? So, looking at like one experience for agents, employees and customers really that's really Okta, right there.

Okta provided that seamless experience across the board for us, Okta provides that strategic touches through integrations. Through this process, I think we had a conversation earlier, we're up to 149 apps that we've integrated in Okta over this two, two and a half year period. We've been able to rapidly roll things out, not just for the new commercial lines company but for the entire enterprise. So we're really getting a lot of value, quick returns out of that, a lot of quick to market value there, right? Okta is right in line with our continuous improvement mentality and approach our innovative thinking. As Okta continues to innovate, we're able to take advantage of that and fold that into the enterprise and you know, you get into dynamic business technology and trusted agent broker relationships, Okta really provides that backbone of the experience that we're trying to provide there. So we've been able to do things much more innovatively, much more seamlessly for the agent. And a lot of that all starts with thinking as identity first, and targeting customer experience there.

So Okta obviously, you know, to kind of sum the sum up the whole thing, the vision process drove us down a path of changing the business and changing our thinking and our culture. That led us to kind of the revelation that identity was kind of the new landscape for security and that focus led us to Okta and this whole journey that we've been on just continues to evolve. So we've been able to drive value faster. We've been able to bring things to market quicker, and we've been able to be very innovative in our thinking and do things that we never thought we could, in a much more rapid pace, which really is a testament to the team, seeing how we've only got four or five of the team members that are really focused on Okta for an organization with 1500 associates supporting 20,000 some agents and close to 700,000 policy holders. We've been really been able to achieve quite a bit in a short period of time. So with that, I'll wrap it up with just a reminder that please complete the session survey cards and thank you for your time, and any Q&A? Thank you. Any questions?

Speaker 1: Okay, thanks Tony. So, a few quick questions. How'd you first come across Okta and then, when it came to time to deliver it up to finance or whoever makes financial decision, how did you ... you aligned it really well with your strategic initiatives, but did you have to go through sort of like ROI analysis? How do you quantify for your financial?

Tony DeAngelo: Well, two things. So we came across Okta first as very much part of the vision process. So Dave was very intentional about this and our first kind of discovery of Okta was actually, our executive. So Motorists is based out of Columbus, Ohio. Our executives formed a small team that actually took a trip to Silicon Valley and met with several of the leading companies out there, Linkedin, Google. Did some other visits out there, really tried to embrace, you know, that innovation spirit and culture.

And as part of that trip, they met with a VC out there that actually brought Okta in and pitched while the executives were there. So that was the real first key takeaway was it wasn't an IT discovery, it came really through our executives. But then as we started doing our kind of IT discovery of that, it really was ... We weren't really ROI driven as much as it was Dave pushing everybody to be empowered with creative thinking. So it comes really back to that cultural shift of we weren't hampered by this has to meet an ROI objective, it has to meet a certain budget number. It was, how do we achieve this new way of thinking that we want to do with technology? And that's really what drove us to Okta and, and really drove us down this a two, two and a half year relationship with Okta that we've had. Yes.

Speaker 2: You mentioned that your CEO came up with this vision of cloud first. mobile first. This whole the New Co. Was it your CEO who also understood the importance of identity in that? Or was that interview and your technology team who came to that conclusion and then had to go make the case for identity to your CEO and the rest of the company?

Tony DeAngelo: So Dave had a very high level vision. He didn't get down into the weeds of technical security or technology. He wasn't really thinking identity specifically, and it was through that strategy and objective process. So it was the strategy team that I was part of that team and when we started the strategy team that was formed to kind of outline and define our approach for New Co, the transformation program. And so, as we started talking about what is it going to take to frame this company up, the more we talked, the more the revelation of we need to focus on identity, came to light. And that actually, that strategy team formed a specific objective team to actually dig into identity and that just kind of started the snowball. And then from there, we've kind of revamped our approach to security. We've revamped our thinking as a company and we've revamped our focus with that realization that identity is that important, right? Not just for security and technology, but for that business relationship as well.

Speaker 3: Thanks very much for your presentation, Tony. As you guys were migrating and implementing Okta, did you experience any technical challenges? You know, did you have custom apps that you had to like have professional services help hook you up with to integrate, any quality type stuff that you might want to call out? Kind of interested in that.

Tony DeAngelo: Yeah, we had all of that. So, you know, the integrations are never ... No integration is always simple and straightforward. So, we were tackling both new technology and legacy technologies. We had on prem and in cloud. So we were constantly kind of reinventing, right?

So that, yeah, it gets back into that innovative thinking and be willing to make mistakes. So, we would have integrations that we thought would be easy that turned out to be very difficult. We had others that we thought would be difficult that ended up being easy. But we had that framework of this new company and the new way of thinking and so we had PWC at our disposable as our integration partner that brought a lot of expertise. We had also a formed internal with enterprise architecture at the table. We had our engineers and we leveraged a several partners and we had Okta professional services along the way. One of our biggest success stories of one of our biggest challenges really turned out to be one of the biggest successes. And it's that F5 integration. So there's a lot of backstory here that I'll spare you. But we ran into a very technical challenge around the SAML tokens, and being able to bring that solution to life, because we had multiple teams working in parallel, right? And some of those teams would get off course. So we had to bring everybody into a room. We had Okta, we had PWC, we had our staff, we had F5 in the room. And through that collaborative approach, we were able to really get the best out of all the solutions and come up with something that we're still using in production today and really empowered the business to go forward and set us on a path not only to fix the problem at hand, but to outline what the evolution into the future should look like. So as we continue to move down the path, we know where we want to go and we're working with those partners to make sure that we kind of achieve that view.

Speaker 4: I just have a specific question. How long does this transformation take for you?

Tony DeAngelo: So it's an ever-evolving process. We're not ... it's obviously not completed. We're about two, two and a half years down the path on the technical side. So different aspects have taken different lengths, so it's hard to say, but we went live with the new commercial lines company last May. We also announced the affiliation the same month. So for the last year we've been charging down this dual path, so working through the affiliation and launching their commercial line company. And we have to roll that out state by state. So, insurance being heavily regulated, we've to work through all those state regulators.

Speaker 4: Thank you.

Tony DeAngelo: Sure.

Speaker 5: Any words of wisdom? For the folks who are going through the implementation?

Tony DeAngelo: So, words of wisdom wise, I think ... you know, it really gets down to willingness, embrace the innovative thinking. Be willing to make mistakes.

Speaker 5: How are you guys getting through the roadblocks? I think that's what-

Tony DeAngelo: Well, it gets all to pivot and overcome, right? So, seeded question. But no, it really comes down to our ability to collaborate together, right? Bring a lot of resources to bear. Getting the right people around the table. So it's not just having IT at the table, it's having customer experience, it's having the business, it's having the agent management teams, all of those come to the table and talk about that experience. And then when issues or problems arise, really being willing to pivot from the direction we thought we were going and finding a way to overcome it.

It takes a village. In this Oktane18 presentation, watch as Motorist Insurance shows how it takes Okta integration to F5 Secure Customer Access, Mulesoft, and Sailpoint in order for Motorist to have a secure connection while working with PwC.