State of Enterprise App Marketplaces: Learnings from a Milestone Anniversary

When we founded Okta in 2009, integrating applications for our customers into Okta's identity management service was a top priority. We went beyond facilitating sign-in to cloud software and on-premises services by releasing thousands of pre-built integrations to help our customers tap into a wider breadth of applications and increase productivity.

Then, in 2013, we unveiled the Okta Application Network externally, allowing customers and partners to build their own app integrations and add them to the network. We later renamed the service Okta Integration Network (OIN) to reflect the expansion to integration types beyond single sign-on (SSO).

It’s hard to believe that was 10 years ago! What better way to celebrate such a milestone anniversary than a study of the current state of enterprise app marketplaces.

From the beginning, OIN has played an essential role in establishing Okta as a neutral, cloud-native Identity provider. Today, OIN offers a catalog of integrations companies use to give our workforce customers seamless access to the technology and resources they need. OIN has 7,500+ integrations and supports various use cases, including:

- SSO

- Directory and HR sync

- Lifecycle management

- Zero Trust

- Identity proofing

- Social login

- Centralized logging

- Bot or fraud detection

- Automation

- Identity governance and administration (IGA)

- Multifactor authentication (MFA)

- Risk signal sharing

Further, OIN is an organic reflection of overarching business trends. Our annual Businesses at Work report, powered by anonymized data from customers in OIN, provides a bullseye view of digital growth.

And we’re not the only ones interested in the current and future state of these marketplaces. In recent years, these enterprise app marketplaces have become table stakes for successful enterprise software companies. The Bessemer State of the Cloud has predicted two years in a row that cloud marketplaces would emerge as one of the most natural places for SaaS buyers and sellers to transact.

Below, we analyze 16 leading enterprise app marketplaces based on information and data points collected from late 2022 to early 2023.

- Atlassian Marketplace

- Auth0 Marketplace

- AWS Marketplace

- Azure Marketplace

- CrowdStrike Store

- Microsoft AppSource

- Okta Integration Network

- Palo Alto Networks Cortex Marketplace

- Salesforce AppExchange

- ServiceNow Store

- Shopify App Store

- Zapier App Integration

- Slack App Directory

- Snowflake Marketplace

- Stripe App Marketplace

- Zoom App Marketplace

What are enterprise app marketplaces?

We define enterprise app marketplaces as third-party listing portals that serve business customers. We selected marketplaces for this study that could comprehensively reflect current enterprise app marketplace trends. At the same time, we tried to avoid duplication. For example, Google Cloud Marketplace is not on the list since its properties are similar to those of the Amazon Web Services (AWS) and Azure marketplaces. Similarly, the marketplace properties of Workato and Tray.io resemble those of Zapier.

In the following few sections, we’ll review the goals of enterprise app marketplaces, their target users, marketplace capabilities, and the investment required to build and maintain marketplaces.

Enterprise app marketplaces: A look at goals

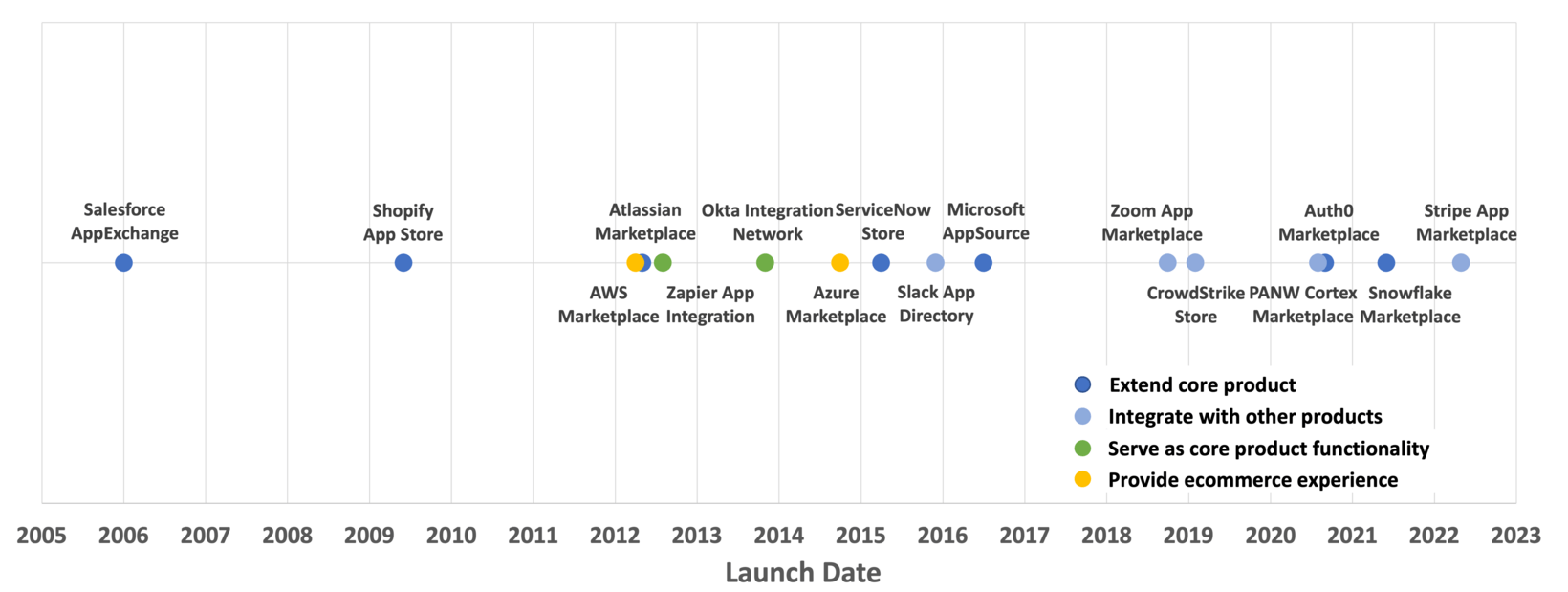

Figure 1: Launch dates and goals of enterprise app marketplaces

Figure 1 shows the 16 enterprise app marketplaces we studied on a timeline according to their launch dates. However, these marketplaces were built for different purposes.

Companies build marketplaces to achieve four goals:

- Extend core product functionality: Salesforce AppExchange is a pioneer in the enterprise app marketplace. Salesforce invested in developer capabilities to make its products customizable and extensible. Some examples include Apex code, the Lightning platform, the packaging/sharing of custom objects, and user interface components. This allows Salesforce to focus investment on core and high ROI product areas and still meet customers’ diverse requirements. Marketplaces from Shopify, Atlassian, ServiceNow, and Auth0 also belong to this category, as indicated by dark blue dots on the timeline. Arguably, Snowflake Data Marketplace also belongs to this category. But instead of providing upstream services to apps in the app marketplace, Snowflake's core products provide downstream services to datasets in its data marketplace.

- Integrate with other products: Best-of-breed SaaS products have proliferated over the last 10 years. And companies use best-of-breed and all-in-one vendors. It has become critical for any product to integrate with other related products from different vendors. Therefore, product integration becomes another motivation for building enterprise app marketplaces. Slack, Microsoft AppSource, Zoom, CrowdStrike, Palo Alto Networks Cortex, and Stripe marketplaces belong to this category, represented with light blue dots in Figure 1. There's a blurred line between the motives of extending core product functionality and integrating with other products. Almost all marketplaces built to extend core product functionality have integrations with other products. On the other hand, most of the marketplaces focused on integration with other products want developers to build applications on top of their products. (The criteria we've used to separate the two is whether a company provides a developer environment to extend their products.)

- Serve as core functionality: Okta Workforce Identity Cloud (WIC) products (SSO, MFA, etc.) are built to easily and securely connect users to applications and other resources. Connecting to other applications is a core functionality of Okta Workforce products. OIN enables ISV partners and Okta customers to integrate applications into Okta products. Aside from OIN, the Zapier App Integration marketplace also belongs to this category, as shown in Figure 1 with green dots.

- Provide ecommerce experience: AWS Marketplace gives builders a simple ecommerce experience to find, buy, and deploy software that runs on AWS. Third-party software procurement and provisioning are the essential components of this marketplace. Aside from AWS Marketplace, Azure Marketplace belongs to this category, as shown in Figure 1 with yellow dots.

Target users of enterprise app marketplaces

From the supply side, the target users of marketplaces are:

- ISVs and developers whose products benefit from integrating with the marketplace providers’ products. Almost all marketplaces belong to this category. ISVs and developers insert their products into UIs/flows of marketplace providers’ products or run them standalone.

- ISVs whose customers benefit from integrating with the marketplace providers’ products.. ISVs come to OIN because we allow our customers to easily and safely use these 3rd party products.

- Developers or ISVs who build applications on the marketplace platform or for the marketplace providers’ products. Developers or ISVs go to Salesforce AppExchange, Shopify App Store, Atlassian Marketplace, and ServiceNow Store to build applications by leveraging these providers' developer environments and resources.

- Developers whose customers overlap with marketplace customers. Almost all marketplaces belong to this category. AWS Marketplace, Azure Marketplace, AppSource, Salesforce AppExchange, Atlassian Marketplace, ServiceNow Store, and Shopify App Store monetize these relationships.

The target users of marketplaces from the demand side are:

- The marketplace providers’ existing customers. For example, companies come to Salesforce to buy customer relationship management (CRM) products and explore AppExchange to meet their CRM needs. Similarly, companies/developers come to Auth0 to build identity. They explore Auth0 Marketplace to meet their specific identity needs and use cases. In this case, it is unlikely that marketplace listings will bring direct new sales/leads for the marketplace providers.

- Users who need the functions provided by the marketplaces. One example: Potential customers find Zapier using Google search, sign up for free, feel the Zapier integrations are useful, explore more integrations, and eventually become paid users. In this case, a positive feedback loop exists between the marketplace listings and the core marketplace products. Another example: When companies want to allow users to use SSO to consume apps, they use Okta as an identity provider, and their IT admins configure SSO with the help of OIN resources.

Key capabilities of enterprise app marketplaces

There are three explicit marketplace capabilities:

- Infrastructure capability: dashboards, search and selection functions, listings (logo, name, description, review, compatible with product feature, installation guide), provider info, and submission and approval processes.

- Integration capability: APIs or SDKs or standards supports, pro-code developer environments, low/no code tools, user interface (UI) touchpoints on the product platforms, listing trial, deployment, or buying options.

- ecommerce capability: pricing model, payment processing, billing, tax, enterprise license agreement bundling, and customer management.

In addition, one implicit marketplace capability of partnership and ecosystem includes co-marketing, co-sell, and customer education.

Figure 2: Key capabilities of enterprise app marketplaces

Figure 2 scores enterprise app marketplace capabilities according to the following criteria:

- Infrastructure: 0.8 for dashboards and listing pages; 0.2 for submission documentation and processes

- Integration: 0.4 for integrations with/to APIs, SDKs, and data; 0.2 for third-party UI touchpoints; 0.2 for pro-dev environments, 0.2 for no/low tools

- ecommerce: 1 for complete ecommerce capabilities, 0.5 for partial ecommerce capabilities, 0 for no ecommerce capabilities

For the sake of simplicity, the scoring criteria don’t consider the quality of implementations. For example, all marketplaces get 0.8 points due to their dashboard and listing components, but some dashboard and listing page designs are better than others.

Traction of enterprise app marketplaces

Figure 3a: The number of integrations per marketplace

Figure 3b: The number of listings per marketplace vs. launch dates

The number of available listings indicates how much traction marketplaces have gained. Figure 3a shows the number of listings per marketplace. Figure 3b plots these listing numbers as a function of launch dates. In general, the listing numbers are roughly proportional to the age of marketplaces. However, the listing number per age year is much larger for AWS and Microsoft marketplaces.

Enterprise app marketplaces matrix

Figure 4: Enterprise app marketplace matrix

We looked at enterprise app marketplaces from the two aspects: comprehensive marketplace capabilities and gaining traction with plenty of listings. Figure 4 plots capability*traction in a 2X2 matrix. We used the logarithm of the listing numbers as a measure of marketplace traction. We separated the enterprise app marketplaces into four quadrants.

- Marketplaces with >2000 listings and >2 capability scores are in the Leader quadrant. AWS Marketplace, Azure Marketplace, Microsoft AppSource, Shopify App Store, Salesforce AppExchange, and Atlassian Marketplace are in the Leader quadrant. Their companies are cloud providers and well-established enterprise software providers who are resourceful to build the breadth and depth of the integrations.

- Marketplaces with >2000 listings and <=2 capability scores are in the Achiever quadrant. Okta Integration Network, Zapier App Integration, Slack App Directory, and Zoom App Marketplace are in the Achiever quadrant. Their companies are best-of-breed SaaS vendors where connecting with a vast amount of applications plays critical roles in their products.

- Marketplaces with <=2000 listings and >2 capability scores are in the Innovator quadrant. ServiceNow Store and Snowflake Marketplace are in the Innovator quadrant. Their companies are vendors that are innovative in exploring various ways to integrate with third-party applications.

- Marketplaces with <=2000 listings and <=2 capability scores are in the Incubator quadrant. Palo Alto Networks Cortex Marketplace, Auth0 Marketplace, CrowdStrike Store, and Stripe App Marketplace are in the Incubator quadrant. Their companies are enterprise software providers that focus on emerging types of marketplaces.

Investment in enterprise app marketplaces

Figure 5: Success vs. investment of enterprise app marketplace in a log-log plot

We performed keyword searches in Linkedin Talent Insights. The keywords were carefully selected, usually the names of enterprise app marketplaces and developer environments. We used the number of professional profiles returned from keyword searches as a metric representing investments to build and maintain the marketplaces. The accuracy of this method is far from perfect. For example, looking at the details of the returned LinkedIn profiles; not all of them have relevant marketplace experience. Also, people may not include work details or mention marketplace experience in their profiles, thus underestimating the profile counts. On the other hand, keyword matches may be from people’s previous roles, thus overestimating the profile counts. Also, the keyword search method doesn’t count for resource investment that's not tied to personnel, such as the cost of infrastructure and software. Nevertheless, the keyword search method is one publicly available way to get a rough idea about product investment.

In Figure 5, we explore the relationship between success (capability*traction) and investment. To make the data points less crowded near the origin, we plot success vs. investment in a log-log plot. We use power regression to fit the data points. We find that enterprise app marketplace success is almost linearly proportional to investment. Investment can explain more than half of the success of the enterprise app marketplaces. However, with only 16 data points, it may be hard to draw a statistical conclusion on the investment vs. success relationship. Moreover, the cause-and-effect relationship between investment and the success of marketplaces is more complicated than the one illustrated here. Investments are responsible for the marketplaces’ success, and a successful marketplace gains more investments and commitments, then greater success, and even more investments. Therefore, the snapshot investment data can only explain part of the story.

It’s just the beginning

Enterprise app marketplaces have evolved a great deal over the past decade as many enterprise software companies have launched their own marketplaces customized to different industries and buyers.

No gift is better than the opportunity to learn and grow. As we celebrate the 10th anniversary of OIN, this study provides food for thought on how we can bring Okta marketplaces to the next level. Guided by feedback from our customers and developers, we will continue to evolve our marketplace and add new integrations to help you glean even more value from your existing technologies.

To learn more, browse all of our integrations, or for developers, join our community of builders to grow your business with OIN.