Why Identity is the I in… Time Tax

Here’s the second blog in our series detailing how focusing on Identity can help your organization improve end-user experiences and meet consumer expectations.

If you work for or support a government agency, you’re well aware of the recent legislative and industry push to improve digital experiences for the American public.

Examples run from the Cabinet to the pages of industry reports:

- The White House recently issued the Tackling the Time Tax report. The document highlights efforts made by a US Department of Labor (DOL)-sponsored tiger team to improve the processes of state-run labor agencies.

- There is pending legislation to develop an “annual customer experience (CX) plan”.

- The annual Forrester CX Index rates industries’ CX quality nationally from 1 to 100.

- Twenty-six out of 35 “High Impact Service Providers” are already publicly reporting data on their interactions with the public.

- Recovering from a disaster ‘Life Experience’ project includes calculating a more holistic burden estimate

Why the extensive focus on user experience? Because, although unintentional and often invisible to agencies themselves, users are experiencing barriers keeping them from needed, designated services. The legislative branch is signaling the need to improve government services. One of the best routes to compliance for every agency is through a focus on Identity.

Similar to how the FITARA Scorecard helps the largest Federal agencies gauge their level of IT modernization relative to comparable agencies, the Okta Time Tax Scorecard does something similar. It was designed to help agencies objectively evaluate their current level of readiness for adopting new CX standards—in conjunction with today’s high consumer expectations. Read on for a primer on the ”time tax”: what it is, why it matters, and what your agency needs to do about it today.

The time tax, explained

Though it takes many forms, the time tax generally refers to the "unnecessary" friction end users experience when seeking out public assistance. The time tax can include the monetary and psychological costs that come with interacting with the government for needed services, as well as the wasted time.

Consider the time and energy it takes applicants to navigate confusing, complicated paperwork and/or online portals. Or the potential lost income from visiting a government office in the middle of a workday. Combine these end-user hurdles with the staffing issues experienced by tightly budgeted government agencies, and the time tax continues to grow for everyone.

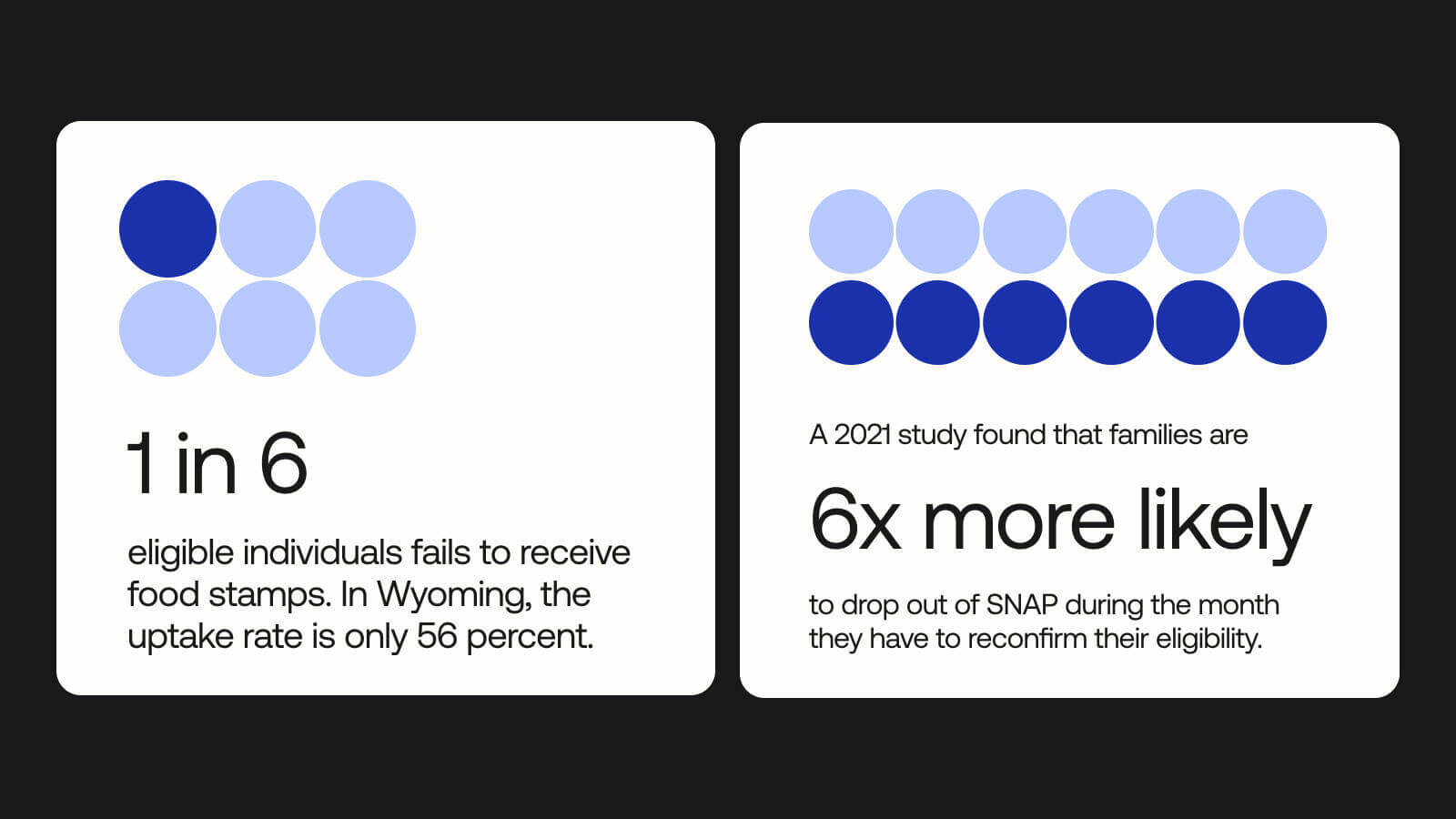

And it’s not just about inconvenience: the time tax is most felt by underserved populations and those most in need. Most importantly, the time tax prevents agencies from living up to their true mission—apportioning services for the public good.

In addition to creating hurdles against public access, the time tax chips away at Americans’ confidence in their government’s ability to properly address their needs. When individuals, families, and small businesses get stuck in the machinery of benefit distribution––or when faulty processes prevent them from accessing benefits and services for which they are eligible––it severely erodes public trust. Federal agencies should see this loss of trust for what it is: A crisis.

How to catch up to evolving CX standards

Of course, as seasoned public service leaders already know, some administrative burdens are necessary. Policy guardrails and verification requirements exist to ensure that benefits and services are only delivered to eligible recipients. These abuse-prevention efforts sometimes clash with efforts to improve CX, which has historically led to the former being prioritized over the latter.

However, in order to comply with new administrative and consumer pressures, agency leaders must let go of the notion that seamless CX and secure service delivery cannot coexist. Modern Customer Identity and Access Management (CIAM) gives agencies a robust set of tools for verifying and authenticating users’ identities without introducing excessive friction into the process. The result is a secure, seamless customer experience that keeps user (and government) data safe while efficiently guiding citizens through benefit application and management.

Put your agency to the test

Don’t wait for a mandated CX report. Take our Time Tax Quiz to assess whether your approach to Identity is effectively serving your users or imposing a costly time tax.