Open Banking is Sweeping the Globe— Don’t get Stuck in Yesterday’s Model

Have you heard the buzz around Open Banking? For anyone in the financial services industry, you should be more than familiar. Open Banking is revolutionizing consumer banking and redefining it as a customer-centric ecosystem for banks and third-party providers.

Driven by the European Union (EU) adoption of the revised Directive on Payment Services (PSD2) in 2018, Open Banking was designed to support three important principles:

- Better consumer protection

- Secure payment schemes with strong customer authentication

- Innovative services and products accessed through the Open Banking concept

In terms of implementation, the UK and EU are clearly leading the way. But, in terms of adoption, Latin America and countries such as Japan and Australia are close behind. And, as it continues to mainstream across the globe, Open Banking is also finding its way to Canada, as well as the U.S., where the Financial Data Exchange (FDX) is gaining momentum in standardizing various digital and Open Banking practices.

It’s clear that banks, financial technology (fintech), and all financial institutions should take note that Open Banking is growing. According to Statista, 24.7 million people worldwide used Open Banking services in 2020. This stat is forecasted to quintuple by 2024.

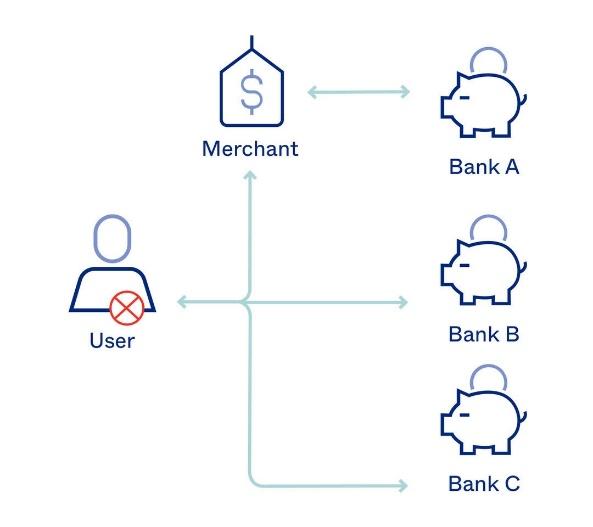

Yesterday: transaction-centric

Before Open Banking (i.e., back in yesterday’s banking model), banks and merchants only benefited from payments and transactions. It was less about customer experience and all about transactions. This model provided similar products, services, and experiences across all banks, but caused a lot frustration for consumers. This dissatisfaction was due to the manual processes required to access their banking services—a different process for each financial institution. Each one was compartmentalized and siloed, and there was no way to share data (e.g., spending patterns or saving metrics) between them.

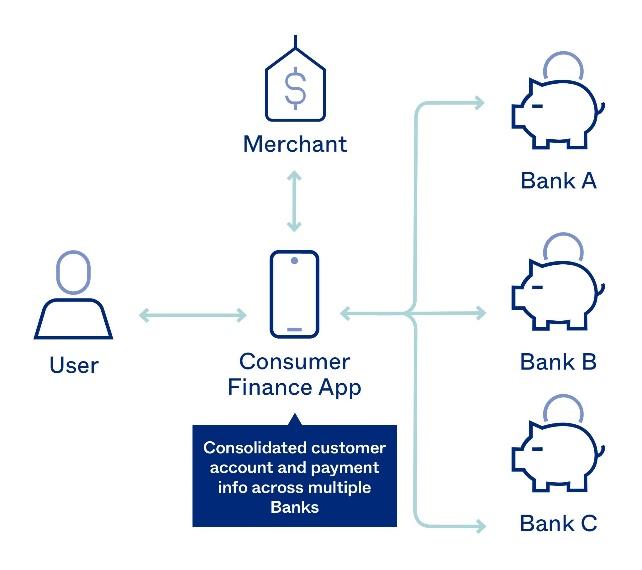

Today: consumer-centric

Fast forward to Open Banking, a prime example of the “consumer-centric” model. This modern banking approach benefits all parties—consumers, banks, and fintech companies—because financial instructions can expose and share customer data to third-party providers via APIs. In this model, consumers are given a unified dashboard view of all their interconnected financial services. This allows them to make quick, secure payments and or/access services directly between service providers. It is a frictionless, secure, and streamlined way for consumers to access their financial information.

As the banking industry evolves, and regulatory requirements continue to grow, Open Banking should be a part of every financial institutions’ modernized business strategy. Having one that is both customer-driven as well as secure, safe, and robust will put you on the forefront of this paradigm shift, as it benefits everyone:

Consumers: Have a clear and centralized view of finances in one place, helping them to budget, find deals, and shop for products and services. They also enjoy streamlined payments between their banks and other services.

Banks: Can expand their offerings by opening APIs to connect with partners, alliance partners, and other service providers, as well as platforms to integrate services. And through the digitization of banking services, they can analyze customer behavior to develop more personalized and relevant services.

FinTech companies: Can quickly launch products and services in agile environments to compete and gain market share, expand collaboration with banks to broaden their portfolio, and integrate other platforms for added security.

The takeaway

Don’t be left behind or caught off-guard by the world-wide momentum seen around Open Banking. It’s just a matter of time before it comes to your region and/or sector.

Not sure where to begin? Check out our Open Banking and PSD2 page to get the details today!