For today’s tech leaders, the future of work isn’t just a hot topic; it’s an essential one. Understanding where work is heading lets us anticipate trends, adapt strategies, and stay competitive.

Fortunately, small-and-midsize businesses (SMBs) can give us a preview. SMBs lead the way in embracing new technologies, offering valuable insights for innovation and efficiency. By learning from their agile approaches, we can better navigate the evolving work landscape and ensure our strategies remain effective and relevant.

In our new report, SMBs at Work 2024, we explore the dynamic digital landscape of SMBs today. Powered by millions of data points from apps in the Okta Integration Network, the report details how today’s growing companies are setting future app trends, doubling down on essential functionality, and strengthening their approaches to security.

“Larger businesses want to know what the best-of-breed apps are. Smaller businesses define what the best-of-breed apps are, and our data proves it.”

Here are some of the key findings from SMBs at Work 2024.

SMBs are focusing on core functionality

Across the board, SMBs invested in the fundamentals this year, adopting tools for signing contracts, stocking offices, and building brands.

The top app category for SMBs was legal tools, led by apps like LegalZoom, DocuSign, and Rocket Lawyer. Legal apps grew 51% by number of customers and 43% by unique users year over year.

Other popular app categories included design software — like Canva, Figma, and Adobe Creative Cloud — which rose 21% by number of customers compared to the previous year, and business supplies (such as Amazon Business), which was up 42% by unique users.

SMBs are strategically investing in technology by reinforcing what has already proven effective, doubling down on existing solutions. This year, popular categories among SMBs, such as apps for content collaboration, security, sales and marketing, cloud platforms, and developer tools, have all shown notable growth, indicating increased user and customer adoption.

However, despite being among the top apps utilized by SMBs, video conferencing apps have not penetrated the growth quadrant, suggesting that while widely used, they may not be experiencing significant expansion beyond their current user base. Understanding these dynamics enables SMBs to make informed decisions regarding technology investments, focusing on areas primed for growth and productivity enhancement.

Popular apps change with company size

At a certain point, all growing companies reevaluate the tools they use to power their operations. As their needs grow and diversify, they adopt additional apps with new functionality. We dug into the data to gain insights into the points at which the leading app in a particular category typically transitions to a different solution.

For example, among businesses with up to 50 employees, Google Workspace overtook Microsoft 365 as the single-most-popular app this year, growing a stunning 77% by unique users and 30% by number of customers. But for larger organizations (SMBs and businesses overall), those relative positions are reversed, with Microsoft still taking the top spot.

A similar inflection happens in the travel category. Among small businesses, TravelPerk is the most-deployed travel app. But for companies with 51 or more employees, the top travel app shifts to Navan.

It takes a little longer, but a similar flip occurs for finance apps; when companies reach 80 employees, their preferred finance app switches from QuickBooks to Oracle NetSuite.

Some apps have seen incredible growth among SMBs, which may be a predictor of future adoption by larger companies:

- Canva was the fastest-growing app among SMBs, surging 76% by customers and 171% by unique users. However, it doesn’t yet rank among the top 50 apps for all companies.

- Twilio SendGrid was a growth leader, up 47% year over year by customers and 76% by unique users. Notion showed similar growth, up 42% by customers and 67% by unique users. However, neither app was deployed enough by larger companies to make the top 50 app list.

- Lattice grew 24% by customers and 24% by unique users year over year but was a growth leader only among SMBs.

SMBs double down on security, compliance, and authentication

The report also finds that compliance and security apps have seen healthy growth, thanks partly to surging adoption by SMBs. This suggests that SMBs are taking a proactive stance in safeguarding data and adhering to regulatory standards, which is crucial for maintaining trust in today's digital landscape.

A growing focus on security

For security apps, the top category this year was VPN/Firewall, which grew 12% year over year across all companies. Within SMBs, VPN/Firewall apps actually grew slightly faster, at 14%.

However, another category of security apps saw the fastest growth this year. That crown goes to compliance tools, which surged a staggering 137% in deployment among SMBs.

Embracing higher-assurance factors

SMBs are also strengthening security around user authentication.

The report shows SMBs shifting away from lower-assurance authentication factors, like security questions, and toward higher-assurance ones, like biometrics. Usage of lower-assurance factors is down an average of 12% year over year, while adoption of higher-assurance factors like security keys and biometrics is up by double digits nearly everywhere.

By industry, the nonprofit sector showed the fastest-growing adoption of high-assurance factors, including 40% growth in security key or biometric factor deployment.

The rising use of stronger authentication methods like security keys and biometrics signifies a proactive approach to bolstering security. This is essential for safeguarding sensitive data and reducing the risk of unauthorized access, particularly in today's interconnected digital landscape.

Passwordless authentication on the rise

Finally, passwordless authentication is gaining popularity among SMBs, and this year’s Okta FastPass data reveals that many of those passwordless logins are being protected by biometrics. Passwordless authentication boosts security, enhances the user experience, and reduces costs. It thwarts password-related risks, simplifies logins, and aligns with evolving security needs.

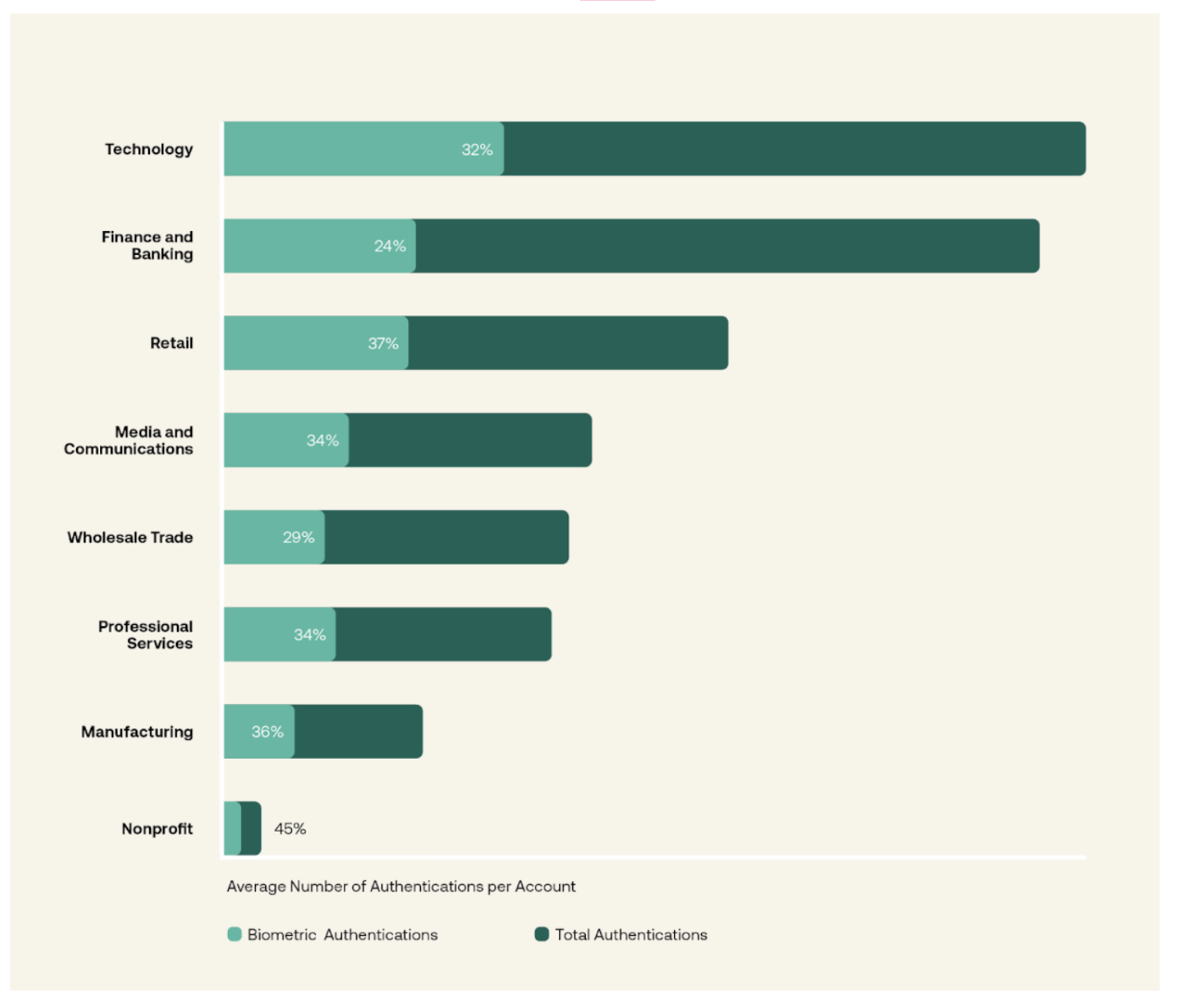

Leading the way in FastPass authentications per account were the technology, finance and banking, and retail sectors. In technology, 32% of those authentications were protected with biometrics; in finance and banking, it was 24%; in retail, it was 37%.

Passwordless authentications with FastPass for SMBs, by industry

Note: This data is based on one year of cumulative FastPass data from Workforce Identity customers.

Read the full report

When it comes to the apps and tools that companies are using to support their workforces, clearly one size does not fit all. To learn more about how SMBs are modernizing productivity and security for their growing organizations, download SMBs at Work 2024.

And for a comprehensive look at the solutions that companies of all sizes are adopting today, read our flagship report, Businesses at Work 2024.